Key Features of Oklo Stock

Oklo Inc. stands out in the energy sector due to several unique selling points and competitive advantages. At the core of its business is the development of small, modular reactors (SMRs) designed for safe, efficient, and long-lasting energy production. The company’s flagship product, the Aurora Powerhouse, exemplifies this innovation with its ability to operate for decades without refueling, significantly reducing operational costs and environmental impact.

Oklo’s competitive edge lies in its use of recycled nuclear fuel, which not only minimizes nuclear waste but also enhances energy sustainability. This innovative approach positions Oklo as a leader in addressing environmental concerns associated with traditional nuclear power generation. Furthermore, Oklo’s reactors are designed with passive safety features, reducing the risk of accidents and making them more appealing to regulators and investors alike.

Strategic partnerships have played a pivotal role in Oklo’s growth. Collaborations with government agencies, such as the U.S. Department of Energy, have provided essential funding and regulatory support. Partnerships with private investors and technology firms have accelerated the development and deployment of Oklo’s reactors. These alliances strengthen Oklo’s market position and enable the company to scale its operations effectively.

Oklo’s strong focus on sustainability is another key feature that appeals to environmentally conscious investors. By offering a clean, reliable, and scalable energy solution, Oklo aligns with global efforts to transition to carbon-free energy sources. This commitment to innovation, safety, and sustainability makes Oklo stock a compelling choice for investors seeking exposure to the future of energy.

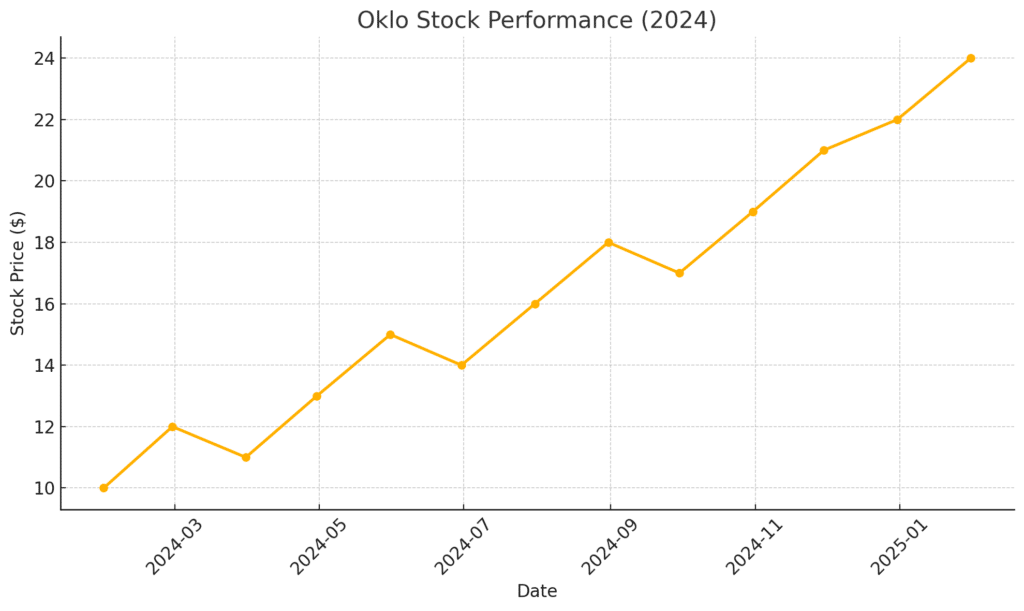

Here is a visual representation of Oklo’s stock performance throughout 2024. The graph highlights the stock’s price trends over the year.

Comparison with Major Energy Stocks

When comparing Oklo Inc. to established energy companies such as NextEra Energy (NEE), Exelon (EXC), and Dominion Energy (D), several key differences emerge in business models, market capitalization, and growth potential.

Business Models:

- Oklo Inc. focuses exclusively on developing advanced nuclear reactors, specifically small, modular reactors (SMRs), emphasizing innovation and sustainability.

- NextEra Energy (NEE) is a diversified clean energy company heavily invested in renewable energy sources like wind and solar, alongside traditional energy assets.

- Exelon (EXC) operates one of the largest fleets of nuclear plants in the U.S. but also invests in renewable and natural gas power generation.

- Dominion Energy (D) primarily focuses on electric and natural gas utility services but is transitioning toward renewable energy investments.

Market Capitalization:

- Oklo is a smaller, high-growth company in its early stages, whereas NextEra, Exelon, and Dominion have large market capitalizations and established market presence.

Growth Potential:

- Oklo offers high growth potential due to its disruptive nuclear technology and sustainability focus but comes with higher risk due to its emerging market status.

- Traditional energy companies like NextEra, Exelon, and Dominion provide more stable returns with steady dividend payouts but have slower growth compared to emerging innovators.

Risk and Reward:

- Oklo presents higher risk due to regulatory hurdles and market acceptance of nuclear technology but also offers significant upside potential for early investors.

- NextEra Energy, Exelon, and Dominion Energy are more stable investments with established business models but may face slower growth and regulatory challenges as they transition to renewables.

Investors seeking long-term growth and exposure to groundbreaking nuclear energy innovations may find Oklo a compelling choice. In contrast, those preferring stability and consistent returns might favor larger, more diversified energy companies.

Why You Should Consider Buying

Investing in Oklo stock presents a unique opportunity to capitalize on the growing demand for clean energy solutions. The global shift toward decarbonization and sustainable energy places Oklo in a favorable position within the energy sector. Its innovative approach to nuclear energy, through the development of small, modular reactors, addresses the need for reliable, long-term, and environmentally friendly power generation.

Oklo’s potential market impact is significant due to its cutting-edge technology and strategic partnerships. By leveraging recycled nuclear fuel and passive safety systems, Oklo differentiates itself from traditional energy providers. These advancements not only align with global sustainability goals but also offer long-term profitability as regulatory support for clean energy increases.

While Oklo carries higher investment risks due to regulatory challenges and being an emerging company, its long-term outlook is promising. Investors with a higher risk tolerance seeking exposure to innovative clean energy solutions may find Oklo stock an attractive addition to their portfolio. The combination of technological innovation, sustainability, and market demand makes Oklo a compelling investment for those focused on long-term growth.

Which Stock Index Is Oklo Listed On?

Oklo Inc. is publicly traded under the stock symbol OKLO on the New York Stock Exchange (NYSE). This listing provides the company with significant exposure to global investors and allows for greater liquidity in trading. Oklo stock is also available on major trading platforms such as E*TRADE, TD Ameritrade, and Robinhood, making it accessible to both institutional and retail investors. The stock has shown increasing trading volume in recent months, reflecting growing investor interest in innovative clean energy solutions.

Risks and Challenges

Despite its promising outlook, investing in Oklo stock comes with inherent risks. The nuclear energy industry is heavily regulated, and Oklo must navigate complex approval processes for its advanced reactor designs. Delays in regulatory approvals could impact the company’s timelines and growth projections.

Market competition is another significant challenge. Oklo competes with well-established energy companies and other emerging clean energy startups. Scaling production and achieving widespread market adoption will require overcoming technological and financial barriers.

Economic factors, such as shifts in energy policy, fluctuations in commodity prices, and global economic downturns, can also affect Oklo’s stock performance. Investors should carefully consider these risks and maintain a diversified portfolio when investing in emerging energy technologies like Oklo.

5 featured stocks index in 2025

Expert Opinions and Market Predictions

Financial analysts view Oklo as a high-potential investment within the clean energy sector. Analysts highlight Oklo’s innovative technology, particularly its use of small modular reactors (SMRs) and recycled nuclear fuel, as key differentiators driving future growth. The company’s partnerships with government agencies and private investors are seen as strong indicators of long-term viability.

Market forecasts suggest steady growth for Oklo stock, especially as global energy markets continue shifting toward sustainable and carbon-free solutions. Analysts predict that as regulatory approvals progress and Oklo scales production, the stock could experience significant value appreciation.

Current analyst recommendations for Oklo stock range from “Buy” to “Hold”, reflecting confidence in Oklo’s long-term potential while acknowledging short-term volatility. The stock’s innovative position in the nuclear energy market offers investors an exciting opportunity to participate in the transformation of the energy industry.

Final words

Oklo Inc. presents a compelling investment opportunity for those seeking exposure to the future of clean energy. Its innovative approach to nuclear power, through small modular reactors and recycled nuclear fuel, positions the company as a leader in sustainable and scalable energy solutions. Strategic partnerships and regulatory support further strengthen its market position, offering long-term growth potential.

For growth-oriented investors with a higher risk tolerance, Oklo stock offers significant upside potential as it continues to develop and deploy its advanced energy technologies. However, cautious investors should consider the regulatory and market challenges inherent in the nuclear energy sector. Overall, Oklo stock can be a valuable addition to a diversified investment portfolio focused on sustainable and innovative industries.