Introduction to the Ukraine stock market

Navigating the intricate world of stock market investments can be a daunting task, especially when venturing into unfamiliar territories like the Ukraine stock market. As an investor seeking lucrative opportunities, understanding the nuances of this market is crucial for making informed decisions and achieving long-term success. This comprehensive guide aims to equip you with the knowledge and strategies needed to confidently invest in the Ukraine stock market, while mitigating potential risks.

The Ukraine stock market, although relatively young compared to its Western counterparts, has emerged as a promising destination for investors seeking diversification and potential growth. With a steadily developing economy and a growing interest from both domestic and international investors, the Ukrainian market offers a unique blend of challenges and opportunities.

By delving into this guide, you’ll gain insights into the market’s dynamics, key players, and the factors that influence its performance. Armed with this knowledge, you’ll be better prepared to navigate the Ukraine stock market and capitalize on its potential while managing risks effectively.

Stock Market in Ukraine + Europe

The Ukraine stock market is an integral part of the broader European financial landscape. While it operates within the confines of Ukraine’s borders, it is influenced by global economic trends and regional developments. Understanding the interconnectedness between the Ukrainian market and its European counterparts is essential for making well-informed investment decisions.

Ukraine’s stock market is primarily centered around the Ukrainian Exchange (UX), which serves as the country’s leading stock exchange. Established in 2008, the UX is responsible for facilitating the trading of various financial instruments, including stocks, bonds, and derivatives.

One of the key advantages of investing in the Ukraine stock market is its potential for growth. As Ukraine continues to integrate with the European Union and implement economic reforms, the market is expected to attract more foreign investment and experience increased liquidity.

Top 3 list of major stocks in Ukraine

- Kernel Holding S.A.: One of the largest agribusiness companies in Ukraine, Kernel Holding is a diversified producer of sunflower oil, grains, and other agricultural products. With a strong presence in both domestic and international markets, Kernel Holding is a prominent player in the Ukrainian stock market.

- MHP SE: Specializing in the production and sale of poultry products, MHP SE is a vertically integrated company that operates across the entire supply chain, from grain cultivation to meat processing. Its strong market position and diversified operations make it an attractive investment opportunity.

- Ferrexpo Plc: As a leading iron ore producer, Ferrexpo Plc has a significant presence in the global market. With its operations primarily based in Ukraine, the company’s stock performance is closely tied to the country’s mining industry and global commodity prices.

Understanding the current state of the Ukraine stock market

To make informed investment decisions in the Ukraine stock market, it is crucial to understand its current state and the factors shaping its performance. The market’s dynamics are influenced by a range of economic, political, and social factors that can have far-reaching implications for investors.

One of the key factors impacting the Ukraine stock market is the country’s ongoing economic reforms and efforts to align with European Union standards. These initiatives have the potential to attract foreign investment, boost investor confidence, and drive market growth. However, the implementation of these reforms and their effectiveness will play a pivotal role in shaping the market’s future trajectory.

Additionally, geopolitical tensions and regional conflicts can significantly impact the Ukraine stock market’s performance. Investors must remain vigilant and closely monitor developments in the region, as they can have profound implications for the market’s stability and investment opportunities.

Factors to consider before investing in the Ukraine stock market

Before diving into the Ukraine stock market, it is essential to consider a range of factors that can influence your investment decisions and overall success. By carefully evaluating these factors, you can mitigate risks and maximize potential returns.

- Economic Conditions: Assess the current and projected economic conditions in Ukraine, including GDP growth, inflation rates, and consumer spending patterns. These factors can provide valuable insights into the market’s potential and the performance of specific sectors or industries.

- Political Stability: The political landscape in Ukraine can have a significant impact on the stock market. Monitor political developments, government policies, and regulatory changes that may affect the business environment and investor confidence.

- Currency Fluctuations: As an international investor, you must be aware of currency fluctuations between the Ukrainian hryvnia and your home currency. Fluctuations in exchange rates can influence the value of your investments and potential returns.

- Industry Trends: Conduct thorough research on the industries and sectors you plan to invest in. Understand their growth prospects, competitive landscapes, and potential challenges to make informed investment decisions.

- Liquidity and Market Depth: Evaluate the liquidity and depth of the Ukraine stock market. Limited liquidity can make it challenging to enter or exit positions efficiently, potentially impacting your investment strategies.

How to invest in the Ukraine stock market – step by step guide

Investing in the Ukraine stock market can seem daunting, but by following a structured approach, you can navigate the process with confidence. Here’s a step-by-step guide to help you get started:

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to the Ukraine stock market. Many international brokers provide trading platforms that allow you to invest in foreign markets, including Ukraine.

- Research and Select Investments: Conduct thorough research on the companies and sectors you’re interested in investing in. Analyze financial reports, industry trends, and market conditions to identify potential investment opportunities.

- Develop an Investment Strategy: Determine your investment goals, risk tolerance, and time horizon. Based on these factors, formulate an investment strategy that aligns with your objectives and risk profile.

- Place Your Trades: Once you’ve identified the stocks or other financial instruments you want to invest in, place your trades through your brokerage account’s trading platform.

- Monitor and Manage Your Portfolio: Regularly monitor your investments and adjust your portfolio as needed. Stay informed about market developments, company news, and any changes that may impact your investments.

- Consider Diversification: Diversifying your portfolio across different sectors, industries, and asset classes can help mitigate risk and potentially enhance returns.

- Seek Professional Advice: If you’re new to investing or unsure about specific aspects of the Ukraine stock market, consider seeking advice from a qualified financial advisor or investment professional.

Top list of stock index in Ukraine

Stock indices play a crucial role in tracking the performance of a country’s stock market and serving as benchmarks for investors. In Ukraine, several key indices provide valuable insights into the market’s overall health and sector-specific trends. Here are the top stock indices in Ukraine:

- PFTS Index: The PFTS Index, also known as the Ukrainian Exchange Index, is the primary stock market index in Ukraine. It tracks the performance of the most liquid and actively traded stocks on the Ukrainian Exchange (UX).

- UX Index: The UX Index is another widely followed index that measures the performance of the top companies listed on the Ukrainian Exchange. It serves as a valuable benchmark for investors focused on the broader Ukrainian market.

- UX Sector Indices: In addition to the broad market indices, the Ukrainian Exchange also maintains sector-specific indices, such as the UX Energy Index, UX Metals and Mining Index, and UX Consumer Goods Index. These indices provide insights into the performance of specific industries within the Ukrainian market.

- UX Dividend Index: For investors interested in dividend-paying stocks, the UX Dividend Index tracks the performance of companies listed on the Ukrainian Exchange that consistently distribute dividends to shareholders.

- UX Blue Chip Index: The UX Blue Chip Index comprises the most liquid and capitalized stocks traded on the Ukrainian Exchange, representing the country’s largest and most established companies.

Tips for successful investing in the Ukraine stock market

Investing in the Ukraine stock market can be a rewarding endeavor, but it also comes with its fair share of challenges. To navigate these challenges and increase your chances of success, consider implementing the following tips:

- Diversify Your Portfolio: Diversification is a fundamental principle of investing, and it holds true for the Ukraine stock market as well. Spread your investments across different sectors, industries, and asset classes to mitigate risk and enhance potential returns.

- Stay Informed: Stay up-to-date with the latest news, economic developments, and regulatory changes that may impact the Ukrainian market. Follow reputable financial news sources, industry publications, and company announcements to make informed investment decisions.

- Employ Fundamental and Technical Analysis: Combine fundamental analysis, which involves evaluating a company’s financial statements, management, and industry trends, with technical analysis, which focuses on studying price patterns and market indicators. This dual approach can provide a more comprehensive understanding of investment opportunities.

- Invest for the Long-Term: While short-term trading strategies can be lucrative, investing in the Ukraine stock market may be more suitable for long-term investors. By adopting a long-term perspective, you can weather market fluctuations and capitalize on the potential growth of the Ukrainian economy.

- Manage Your Risk: Implement risk management strategies, such as stop-loss orders, portfolio rebalancing, and position sizing, to protect your investments from excessive losses. Regularly review and adjust your risk management approach as market conditions change.

- Consider International Diversification: While investing in the Ukraine stock market provides diversification benefits, you may also consider diversifying your portfolio across international markets. This can further mitigate risk and potentially enhance returns.

Strategies for navigating the challenges of the Ukraine stock market

Investing in the Ukraine stock market can present unique challenges that require strategic navigation. By employing the following strategies, you can better position yourself to overcome these challenges and capitalize on potential opportunities:

- Understand Cultural and Regulatory Differences: The Ukrainian market operates within a distinct cultural and regulatory framework. Familiarize yourself with local business practices, corporate governance standards, and regulatory requirements to make informed investment decisions.

- Leverage Local Expertise: Consider partnering with local financial advisors, investment professionals, or reputable brokerage firms that have in-depth knowledge of the Ukrainian market. Their expertise can provide valuable insights and guidance as you navigate the market’s intricacies.

- Adopt a Long-Term Mindset: The Ukraine stock market may experience periods of volatility and uncertainty, particularly in the face of geopolitical tensions or economic challenges. Adopting a long-term investment horizon can help you weather short-term fluctuations and capitalize on potential long-term growth opportunities.

- Embrace Patience and Discipline: Successful investing in the Ukraine stock market requires patience and discipline. Avoid impulsive decisions based on market noise or short-term fluctuations. Instead, stick to your investment strategy and make well-researched decisions based on sound analysis and risk management principles.

- Monitor Currency Risks: As an international investor, you must be aware of currency risks and fluctuations between the Ukrainian hryvnia and your home currency. Consider hedging strategies or investing in currency-hedged instruments to mitigate potential losses due to exchange rate movements.

- Stay Agile and Adaptable: The Ukrainian market is dynamic, and conditions can change rapidly. Remain agile and adaptable in your investment approach, regularly reviewing and adjusting your strategies as needed to align with evolving market conditions and your investment objectives.

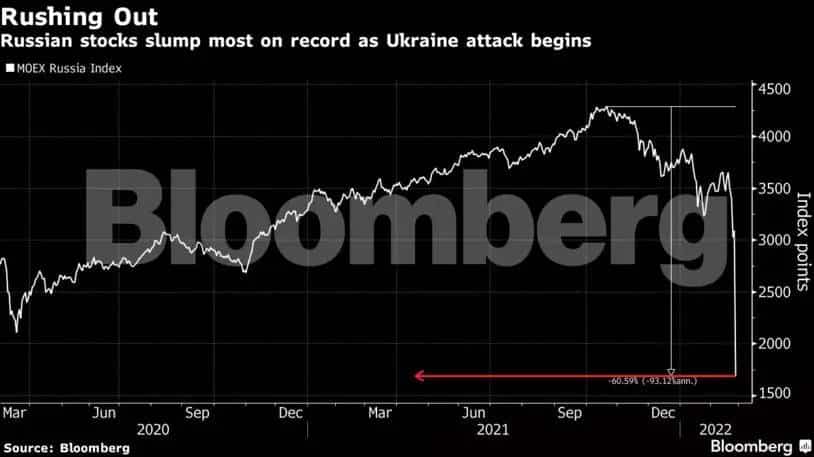

The impact of the war in Ukraine on the stock market

The ongoing war in Ukraine has had a profound impact on the country’s stock market, causing significant volatility and uncertainty. Investors must carefully consider the implications of this conflict and its potential effects on their investment decisions.

One of the most immediate impacts has been the disruption of business operations and supply chains, particularly in regions affected by the conflict. Companies operating in these areas may face challenges in maintaining production, logistics, and overall operations, potentially impacting their financial performance and stock prices.

Additionally, the war has led to increased geopolitical tensions and economic sanctions, which can have far-reaching consequences for the Ukrainian economy and its financial markets. Sanctions and trade restrictions can limit access to international markets, disrupt capital flows, and create challenges for companies seeking to expand or operate globally.

Investor sentiment has also been heavily influenced by the ongoing conflict, with periods of heightened risk aversion and uncertainty. This can lead to increased market volatility, as investors react to news and developments related to the war.

Despite these challenges, some sectors and companies may present opportunities for investors willing to navigate the risks associated with the conflict. Industries such as defense, cybersecurity, and essential goods and services may experience increased demand or potential growth prospects.

Resources for staying updated on the Ukraine stock market

Staying informed about the latest developments and trends in the Ukraine stock market is crucial for making informed investment decisions. Here are some valuable resources to help you stay up-to-date:

- Ukrainian Stock Exchanges: The Ukrainian Exchange (UX) and the PFTS Stock Exchange provide real-time market data, company news, and regulatory updates on their official websites.

- Financial News Portals: Online portals like Bloomberg, Reuters, and the Financial Times offer comprehensive coverage of the Ukrainian market, including news, analysis, and expert commentary.

- Brokerage Research Reports: Many reputable brokerage firms and investment banks offer research reports and analysis on the Ukrainian market, providing valuable insights and recommendations.

- Government and Regulatory Websites: The National Securities and Stock Market Commission of Ukraine and other relevant government agencies publish important information, regulations, and updates that can impact the stock market.

- Industry Associations and Chambers of Commerce: Organizations like the Ukrainian Chamber of Commerce and Industry and industry-specific associations can provide valuable sector-specific insights and market trends.

- Social Media and Online Forums: While exercising caution, social media platforms and online investment forums can be useful for staying informed about market sentiment, news, and discussions related to the Ukraine stock market.

- Financial Blogs and Podcasts: Follow reputable financial blogs and podcasts that cover the Ukrainian market, offering analysis, commentary, and investment strategies from experienced professionals.

Risks and rewards of investing in the Ukraine stock market

Like any investment opportunity, investing in the Ukraine stock market carries both risks and potential rewards. Understanding and carefully weighing these factors is crucial for making informed decisions and managing expectations.

Risks:

- Political and Geopolitical Instability: Ukraine’s political landscape and ongoing conflicts can contribute to market volatility and uncertainty, potentially impacting investment returns.

- Economic Challenges: Ukraine’s economy has faced various challenges, including high inflation, currency fluctuations, and structural issues, which can affect the performance of companies and the stock market.

- Regulatory and Legal Risks: Changes in regulations, taxation policies, and legal frameworks can impact the business environment and investment climate in Ukraine.

- Limited Liquidity: The Ukraine stock market may experience periods of low liquidity, making it challenging to enter or exit positions efficiently.

- Currency Risks: Fluctuations in the exchange rate between the Ukrainian hryvnia and other currencies can impact the value of your investments and returns.

Rewards:

- Diversification Opportunities: Investing in the Ukraine stock market can provide diversification benefits, potentially reducing overall portfolio risk and enhancing returns.

- Growth Potential: As Ukraine continues to develop and implement economic reforms, the stock market may present opportunities for long-term growth and capital appreciation.

- Attractive Valuations: Ukrainian companies may offer attractive valuations compared to their international counterparts, presenting potential value investment opportunities.

- Exposure to Emerging Industries: Ukraine’s economy is evolving, and new industries and sectors may emerge, offering investment opportunities in innovative and high-growth companies.

- Dividend Income: Some Ukrainian companies may offer attractive dividend yields, providing a source of passive income for investors.

By carefully weighing the risks and potential rewards, investors can make informed decisions aligned with their investment objectives, risk tolerance, and overall financial goals.

Is investing in the Ukraine stock market right for you?

Investing in the Ukraine stock market can be a rewarding endeavor for those willing to navigate its complexities and manage the associated risks. However, it is essential to carefully evaluate whether this investment opportunity aligns with your personal financial goals, risk tolerance, and investment horizon.

Before making any investment decisions, consider the following:

- Risk Appetite: Assess your tolerance for risk and volatility. The Ukraine stock market can be subject to significant fluctuations, and your ability to withstand potential losses is crucial.

- Investment Horizon: Determine your investment time frame. If you have a long-term investment horizon, the Ukraine stock market may present opportunities for growth and capital appreciation. However, if you require short-term liquidity, this market may not be the best fit.

- Diversification Strategy: Evaluate how investing in the Ukraine stock market aligns with your overall diversification strategy. It can provide exposure to an emerging market and potentially reduce portfolio risk through diversification.

- Knowledge and Experience: Honestly assess your knowledge and experience in investing in foreign markets. If you lack the necessary expertise, consider seeking professional guidance or investing through managed funds or exchange-traded funds (ETFs) focused on the Ukrainian market.

- Risk Management: Develop a comprehensive risk management plan that includes strategies for mitigating potential losses, such as stop-loss orders, portfolio rebalancing, and position sizing.

Ultimately, investing in the Ukraine stock market is a personal decision that should be made after careful consideration of your financial circumstances, investment objectives, and risk tolerance. By conducting thorough research, seeking professional advice if needed, and implementing sound investment strategies, you can navigate this market with confidence and potentially reap the rewards it offers.

If you’re interested in exploring investment opportunities in the Ukraine stock market, consider opening a brokerage account with a reputable firm that provides access to international markets. Many online brokers offer user-friendly platforms and tools to help you research, analyze, and execute trades in the Ukrainian market. Additionally, consider consulting with a financial advisor who specializes in international investments to ensure you develop a well-diversified portfolio aligned with your risk tolerance and investment goals.

By staying informed, employing sound strategies, and carefully managing risks, you can navigate the challenges and capitalize on the potential opportunities presented by the Ukraine stock market. Remember, successful investing is a journey that requires patience, discipline, and a willingness to continuously learn and adapt. Embrace the adventure, and may your investments in the Ukrainian market yield fruitful returns.