Overview of the Moscow Exchange (MOEX)

The Moscow Exchange (MOEX) is the primary stock exchange in Russia, serving as the hub for trading in Russian equities, bonds, derivatives, and commodities. Established in 2011 through the merger of the Moscow Interbank Currency Exchange and the Russian Trading System, MOEX has emerged as a key player in the global financial landscape.

MOEX boasts a robust infrastructure, advanced trading platforms, and a wide range of financial instruments, catering to the diverse needs of both domestic and international investors. The exchange’s liquidity, transparency, and regulatory oversight have contributed to its growing reputation and the increasing participation of foreign investors in the Russian stock market.

Understanding the Key Stock Market Indices – RTS Index and MICEX Index

The Russian stock market is primarily tracked through two key indices: the RTS Index and the MICEX Index.

- RTS Index: The RTS Index (Russian Trading System Index) is a capitalization-weighted index that tracks the performance of the top 50 Russian stocks traded on the Moscow Exchange. The RTS Index is widely regarded as the benchmark for the Russian stock market and is often used as a barometer for the overall health of the Russian economy.

- MICEX Index: The MICEX Index (Moscow Interbank Currency Exchange Index) is a price-weighted index that follows the performance of the 50 most liquid Russian stocks traded on the Moscow Exchange. The MICEX Index is considered a more diversified representation of the Russian stock market, with a broader focus on various sectors and industries.

Both the RTS Index and the MICEX Index are closely monitored by investors, analysts, and policymakers to gauge the sentiment and performance of the Russian stock market. Understanding the dynamics of these key indices is crucial for making informed investment decisions in the Russian market.

Top List of Stock Indices in Russia

In addition to the RTS Index and MICEX Index, the Russian stock market is home to several other notable indices that provide insights into the performance of specific sectors and market segments:

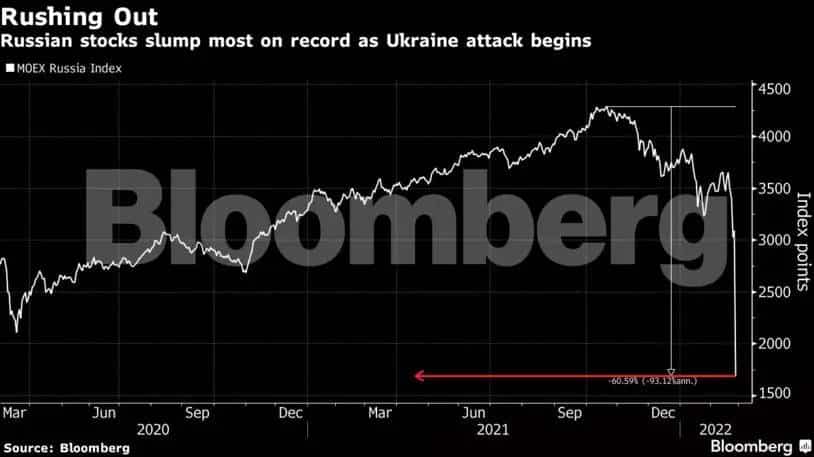

- MOEX Russia Index: This index tracks the 50 most liquid Russian stocks traded on the Moscow Exchange, serving as a broader representation of the Russian stock market.

- MOEX Broad Market Index: This index encompasses a wider range of Russian stocks, including both large-cap and mid-cap companies, providing a more comprehensive view of the overall Russian stock market.

- MOEX Consumer Goods & Services Index: This sector-specific index focuses on the performance of companies in the consumer goods and services industries, offering insights into the consumer-driven segments of the Russian economy.

- MOEX Oil & Gas Index: As a major global producer of oil and gas, Russia’s energy sector is closely tracked through this industry-specific index, which follows the performance of leading Russian energy companies.

- MOEX Financials Index: This index concentrates on the financial sector, providing investors with a lens into the performance of Russian banks, insurance companies, and other financial institutions.

By monitoring the movements and trends of these diverse stock indices, investors can gain a deeper understanding of the dynamics and opportunities within the Russian stock market.

Analyzing Russian Equities and Blue-Chip Stocks

The Russian stock market is home to a diverse array of public companies, ranging from large-cap blue-chip stocks to promising mid-cap and small-cap equities. Analyzing the performance and potential of these Russian equities is crucial for investors seeking to capitalize on the growth and stability of the Russian market.

Blue-chip stocks, such as Gazprom, Sberbank, and Lukoil, are considered the backbone of the Russian stock market. These companies are known for their market dominance, financial strength, and consistent performance. Investors often turn to these blue-chip stocks as a means of gaining exposure to the Russian economy and its key industries.

Beyond the blue-chip segment, the Russian stock market also offers opportunities in the mid-cap and small-cap spaces. These emerging companies, while potentially more volatile, can present attractive growth prospects and the potential for higher returns. By diversifying your portfolio to include a mix of Russian equities, you can enhance your exposure to the various sectors and growth dynamics within the Russian market.

Exploring Emerging Market Opportunities in Russia

As an emerging market, Russia presents a unique set of opportunities for investors seeking to capitalize on the country’s economic growth and development. Beyond the well-established blue-chip stocks, the Russian stock market is home to a thriving ecosystem of smaller, innovative companies that are poised to benefit from the country’s expanding consumer base, technological advancements, and infrastructure investments.

Sectors such as e-commerce, fintech, renewable energy, and healthcare are particularly promising, as they offer exposure to the rapidly evolving consumer and technology landscape in Russia. By identifying and investing in these emerging market opportunities, you can potentially unlock higher returns and position your portfolio for long-term success.

However, it is important to note that investing in emerging markets, including Russia, often comes with increased volatility and risk. Thorough research, risk management, and diversification are crucial when exploring these opportunities to ensure a balanced and well-informed investment strategy.

Evaluating Dividend Yields and Market Capitalization in the Russian Stock Market

Dividends and market capitalization are two key metrics that investors should consider when analyzing the Russian stock market. Many of the leading Russian companies, particularly in the energy and financial sectors, have historically offered attractive dividend yields, providing a steady stream of income for investors.

When evaluating the Russian stock market, it’s essential to examine the dividend policies and track records of the companies you’re considering. High-yielding dividend stocks can be a valuable component of a diversified portfolio, offering a balance between growth and income.

Additionally, the market capitalization of Russian companies is an important factor to consider. The Russian stock market is home to both large-cap blue-chip stocks and smaller, mid-cap and small-cap equities. Understanding the market capitalization dynamics can help you identify investment opportunities that align with your risk tolerance and diversification goals.

By carefully analyzing dividend yields and market capitalization, you can make more informed decisions and position your investments to capture the unique opportunities presented by the Russian stock market.

Foreign Investment in the Russian Stock Market

The Russian stock market has long been a destination for foreign investors seeking exposure to the country’s economic growth and development. Over the years, the market has attracted a diverse array of international investors, including institutional funds, hedge funds, and individual investors.

The influx of foreign capital has contributed to the increased liquidity and visibility of the Russian stock market, as well as the adoption of global best practices in terms of corporate governance and transparency. However, the level of foreign investment in the Russian market has fluctuated over time, often influenced by geopolitical tensions, economic sanctions, and other external factors.

Understanding the dynamics of foreign investment in the Russian stock market is crucial for investors seeking to navigate the market’s complexities and capitalize on the opportunities presented by the increased global participation. By monitoring the trends and patterns of foreign investment, you can better gauge the sentiment and potential risks associated with the Russian market.

An In-Depth Look at Stock Trading and Derivatives Market in Russia

The Russian stock market offers a vibrant and sophisticated trading environment, catering to a wide range of investors and financial instruments. Beyond the traditional equity trading, the Russian market also boasts a thriving derivatives market, providing investors with additional tools for hedging, speculation, and portfolio diversification.

The derivatives market in Russia includes a variety of financial contracts, such as futures, options, and swaps, covering a broad range of underlying assets, including stocks, indices, commodities, and currencies. The Moscow Exchange (MOEX) is the primary hub for derivatives trading in Russia, offering a robust and regulated platform for these complex financial instruments.

By understanding the nuances of the Russian stock and derivatives markets, you can explore a more comprehensive range of investment strategies, leveraging the unique opportunities and risk management tools available in this dynamic market. However, it’s crucial to have a thorough understanding of the risks and complexities associated with derivatives trading before engaging in these activities.

Understanding IPO (Initial Public Offering) and its Impact on the Russian Stock Market

The Initial Public Offering (IPO) landscape in Russia has been a crucial driver of activity and growth in the Russian stock market. As companies seek to raise capital and expand their operations, the IPO market has become an important avenue for both domestic and international investors to gain exposure to the Russian economy.

IPOs in Russia have covered a diverse range of sectors, from technology and e-commerce to traditional industries like energy and manufacturing. The successful IPOs of companies like Yandex, the Russian tech giant, and Ozon, the leading e-commerce platform, have highlighted the potential for high-growth, innovative businesses to thrive in the Russian market.

The impact of IPOs on the Russian stock market extends beyond the individual companies going public. These events can influence market sentiment, liquidity, and overall investor confidence, shaping the broader investment landscape. By closely monitoring the IPO activity and trends in the Russian market, you can gain valuable insights into the emerging opportunities and the evolving dynamics of the Russian stock market.

Analyzing Trading Volumes and Commodity Trading in Russia

The trading volumes and commodity trading activities within the Russian stock market are crucial indicators of the market’s liquidity, investor sentiment, and the overall health of the Russian economy.

The Moscow Exchange (MOEX) serves as the primary hub for trading in a wide range of financial instruments, including equities, bonds, derivatives, and commodities. Analyzing the trading volumes and patterns across these asset classes can provide valuable insights into the market’s depth, volatility, and the flow of capital.

Commodity trading, particularly in the energy and industrial sectors, is a significant component of the Russian stock market. As a major global producer and exporter of commodities, such as oil, natural gas, and metals, Russia’s commodity-linked companies and their trading activities have a substantial impact on the overall performance of the Russian stock market.

By closely monitoring the trading volumes and commodity trading dynamics, you can better understand the market’s risk profile, the influence of global commodity prices, and the potential opportunities and challenges that may arise in the Russian stock market.

The Effect of Economic Sanctions on the Russian Stock Market

The Russian stock market has not been immune to the impact of economic sanctions imposed by various countries and international organizations. These sanctions, implemented in response to geopolitical tensions and events, have had far-reaching consequences on the Russian economy and its financial markets.

The imposition of sanctions has led to increased volatility, reduced liquidity, and changes in the investment landscape within the Russian stock market. Certain sectors, such as energy and finance, have been particularly affected, as sanctions have limited access to international capital, technology, and financial systems.

Navigating the Russian stock market amidst the backdrop of economic sanctions requires a deep understanding of the evolving geopolitical landscape, the specific sanctions in place, and their potential impact on different industries and companies. Investors must carefully assess the risks and opportunities presented by the Russian market, taking into account the potential effects of sanctions and their implications for investment strategies.

Investment Strategies for the Russian Stock Market

Investing in the Russian stock market requires a nuanced and well-informed approach. Depending on your risk tolerance, investment objectives, and market outlook, there are several investment strategies you can consider when exploring opportunities in the Russian market:

- Diversified Portfolio Approach: Constructing a diversified portfolio that includes a mix of Russian blue-chip stocks, emerging market equities, and other asset classes can help mitigate risk and provide exposure to the broader growth potential of the Russian economy.

- Sector-Specific Investments: Targeting specific sectors, such as energy, financials, or technology, can allow you to capitalize on the unique strengths and growth prospects of those industries within the Russian market.

- Dividend-Focused Strategy: Identifying Russian companies with a track record of consistent dividend payments and attractive yields can provide a steady stream of income and potentially enhance the overall returns of your portfolio.

- Tactical Trading Opportunities: Leveraging the volatility and trading dynamics of the Russian stock market, you can explore tactical trading strategies, such as short-term position-taking or hedging, to potentially generate returns.

- Emerging Market Exposure: Allocating a portion of your portfolio to promising emerging market opportunities in Russia can offer higher growth potential, but also requires a higher risk tolerance.

Regardless of the investment strategy you choose, it’s crucial to conduct thorough research, understand the market dynamics, and maintain a well-diversified approach to navigate the complexities and capitalize on the opportunities presented by the Russian stock market.

Identifying Market Trends and Sector Performance in Russia

Analyzing the market trends and sector performance within the Russian stock market is essential for making informed investment decisions. By closely monitoring the performance of various industries and identifying emerging themes and patterns, you can position your portfolio to benefit from the dynamic nature of the Russian market.

Some key sectors to watch in the Russian stock market include:

- Energy: As a major global producer of oil, natural gas, and other commodities, the energy sector plays a pivotal role in the Russian economy and stock market.

- Financials: The performance of Russian banks, insurance companies, and other financial institutions can provide insights into the overall health of the country’s financial system.

- Technology and Innovation: Emerging sectors, such as e-commerce, fintech, and renewable energy, are gaining traction in the Russian market and offer potential growth opportunities.

- Consumer Discretionary: The expanding Russian consumer base and the rise of the middle class present opportunities in sectors like retail, hospitality, and consumer goods.

By closely monitoring the market trends and sector-specific performance, you can identify potential investment opportunities, manage risks, and adapt your strategies to the evolving landscape of the Russian stock market.

Overview of Financial Regulations in the Russian Stock Market

The Russian stock market operates within a regulatory framework that aims to ensure market integrity, investor protection, and the efficient functioning of the financial system. Understanding the key aspects of this regulatory environment is crucial for investors navigating the Russian market.

The Central Bank of Russia (CBR) is the primary regulatory authority responsible for overseeing the financial markets, including the stock exchange. The CBR sets policies, establishes rules and guidelines, and enforces compliance to maintain market stability and integrity.

Some of the key regulatory aspects that investors should be aware of include:

- Disclosure and Transparency: Russian publicly-traded companies are required to adhere to strict disclosure and transparency standards, providing investors with timely and accurate information about their financial performance and corporate activities.

- Market Manipulation and Insider Trading: The Russian regulatory framework has measures in place to prevent and punish market manipulation and insider trading, ensuring a level playing field for all investors.

- Investor Protection: Russian financial regulations include provisions to safeguard the rights and interests of investors, including measures to address disputes and grievances.

- Capital Controls and Currency Regulations: Investors should be mindful of the capital controls and currency regulations that may impact their ability to move funds in and out of the Russian market.

By understanding the regulatory landscape of the Russian stock market, investors can make more informed decisions, navigate the complexities of the market, and ensure compliance with the applicable rules and regulations.

The Potential and Risks of Investing in the Russian Stock Market

The Russian stock market presents a unique and dynamic investment landscape, offering both opportunities and challenges for investors. From the iconic Moscow Exchange to the emerging market prospects, the Russian market has the potential to generate attractive returns for those willing to navigate its complexities.

However, it’s essential to approach the Russian stock market with a well-informed and cautious mindset. Ge Navigating the potential and risks of the Russian stock market requires a comprehensive understanding of the market’s dynamics, regulatory environment, and investment strategies. As an investor, you must carefully weigh the unique opportunities presented by this emerging market against the inherent volatility and geopolitical factors that can impact its performance.

One key consideration is the regulatory landscape. The Central Bank of Russia (CBR) plays a pivotal role in shaping the rules and guidelines that govern the stock market. Compliance with these regulations is crucial, as they aim to maintain market integrity, protect investor rights, and prevent market manipulation. Understanding the regulatory framework can help you make informed decisions and mitigate potential legal and reputational risks.

Volatility is another factor that investors must navigate when exploring the Russian stock market. The market’s performance can be heavily influenced by global commodity prices, geopolitical tensions, and economic sanctions, leading to periods of significant price swings and uncertainty. Developing a well-diversified investment strategy and maintaining a long-term perspective can help you weather these market fluctuations and potentially capitalize on the market’s growth potential.

Sectors such as energy, financials, and technology are particularly prominent in the Russian stock market, and their performance can have a substantial impact on the overall market dynamics. Closely monitoring these industry trends, as well as emerging opportunities in areas like e-commerce and renewable energy, can help you identify promising investment prospects and adapt your strategies accordingly.

Furthermore, the role of foreign investment in the Russian stock market cannot be overstated. The influx of international capital has contributed to the market’s liquidity and visibility, but it has also made it susceptible to global economic and political shifts. Carefully analyzing the trends and patterns of foreign investment can provide valuable insights into the market’s sentiment and potential risks.

As you consider investing in the Russian stock market, it’s crucial to conduct thorough research, consult with financial advisors, and develop a well-diversified investment strategy that aligns with your risk tolerance and long-term financial goals. By navigating the complexities of this dynamic market, you may unlock the potential for attractive returns, but it’s essential to remain vigilant and adaptable in the face of the inherent risks.