What is the Romania Stock Market, and Why is it Significant?

The Stock Market, centered around the Bucharest Stock Exchange (BVB), is a vital component of the country’s financial infrastructure and a significant player among the emerging markets in Central and Eastern Europe (CEE). It serves as the primary platform for trading securities, including equities, bonds, and structured products, providing companies with access to capital and investors with diverse opportunities.

Romania’s stock market has gained attention due to its consistent growth, attractive valuations, and strategic position within the European Union. The market’s progress reflects the broader economic development of the country, characterized by increasing foreign investments, robust GDP growth, and integration into global financial systems. Furthermore, the market’s upgrade from a frontier market to an emerging market by FTSE Russell in 2020 highlighted its maturation and appeal to international investors.

Brief History of the Bucharest Stock Exchange (BVB)

The Bucharest Stock Exchange (BVB) was initially established in 1882 but was disbanded during the communist regime in 1948. It was re-established in 1995, following Romania’s transition to a market-oriented economy after the fall of communism.

Since its relaunch, the BVB has played a crucial role in privatizing state-owned enterprises and modernizing the country’s financial system. Key milestones include:

- The listing of major Romanian companies such as OMV Petrom and Romgaz, contributing to market liquidity.

- The introduction of the BET index in 1997, the first benchmark index of the exchange.

- Significant technological advancements, enabling efficient trading for domestic and international participants.

Primary Indices of the Market

The Romanian stock market uses several indices to measure performance and provide benchmarks for investors. The most prominent indices include:

- BET Index (Bucharest Exchange Trading)

- The first and most important index of the BVB, launched in 1997.

- Tracks the performance of the top 10–20 most liquid companies listed on the exchange, excluding financial investment funds (SIFs).

- BET-TR (BET Total Return)

- A total return version of the BET index that includes price movements and dividend payments, offering a more comprehensive view of returns.

- BET-XT

- Tracks the performance of the top 25 liquid companies, including financial investment funds, providing broader market coverage.

- BET-FI

- An index specifically designed to measure the performance of financial investment funds (SIFs).

- ROTX (Romanian Traded Index)

- A joint venture with the Vienna Stock Exchange, reflecting the performance of Romanian blue-chip companies.

The Romania Stock Market, through its structure and indices, continues to evolve, attracting a mix of local and international investors. It plays a pivotal role in integrating Romania further into global capital markets while fostering economic growth domestically.

Market Performance Over the Past Year

The Romanian stock market has demonstrated strong performance over the past year, with the BET index, which tracks the most liquid companies on the Bucharest Stock Exchange (BVB), increasing significantly. This growth reflects a continuation of the positive momentum from previous years, where the market consistently delivered double-digit returns. Factors like increased trading activity, strong corporate earnings, and the inflow of foreign investments have contributed to this rise.

Key Drivers of Growth

- Economic Stability: Despite global economic challenges, Romania’s economy has shown resilience, supported by government reforms and EU-funded recovery initiatives. These factors have bolstered investor confidence in the country’s capital markets.

- Sectoral Strength: The energy and financial sectors have been major contributors to market growth. Companies like OMV Petrom and Banca Transilvania have delivered strong financial results, driving investor interest.

- Market Maturity: Since being upgraded to emerging market status by FTSE Russell, Romania has seen increased participation from institutional investors. This has improved liquidity and broadened the investor base.

- Increased Retail Participation: The number of individual investors in Romania’s stock market has grown significantly, signaling a broader domestic interest in equity markets.

- Dividends and Total Returns: The Romanian market is known for its high dividend yields, with companies paying substantial dividends, making it attractive for income-focused investors.

Comparison with Other European Markets

The Romanian stock market has outperformed many of its European counterparts in terms of percentage growth over the past year. While major indices like the German DAX and French CAC 40 showed moderate single-digit growth, the BET index recorded double-digit gains, positioning Romania as one of the strongest-performing markets in the region. This highlights its appeal as a growing market within the European Union, particularly for investors looking for higher growth potential compared to more mature markets.

Romania’s stock market performance underscores its potential as a key player in the European financial landscape, with promising opportunities for both domestic and international investors.

Note: The data presented is based on available information up to December 2024. For the most current figures and analysis, consulting the latest reports from the Bucharest Stock Exchange and financial news sources is recommended.

Key Players in the Stock Market

Largest and Most Influential Companies

The Romanian Stock Market, primarily represented by the Bucharest Stock Exchange (BVB), features a mix of major companies across various industries. Some of the largest and most influential companies listed include:

- OMV Petrom

- Sector: Energy

- The largest oil and gas company in Southeast Europe, OMV Petrom is a key player in the Romanian market and a significant contributor to the energy sector’s performance.

- Banca Transilvania

- Sector: Banking

- As one of Romania’s largest banks, Banca Transilvania is a cornerstone of the financial sector, known for its robust financial results and strong market position.

- BRD – Groupe Société Générale

- Sector: Banking

- A major banking institution in Romania, BRD provides a wide range of financial services and is a top choice for investors in the financial sector.

- Romgaz

- Sector: Energy

- A leading natural gas producer in Romania, Romgaz plays a crucial role in the country’s energy market and is a key player in the region’s energy supply chain.

- Transgaz

- Sector: Energy and Infrastructure

- Romania’s national natural gas transmission company, Transgaz, is essential for infrastructure development and energy distribution.

- Electrica

- Sector: Utilities

- A major electricity distributor and supplier, Electrica is critical in Romania’s utility sector, appealing to long-term investors focused on stable dividends.

Sectors Driving the Market

- Energy

- The energy sector, led by OMV Petrom, Romgaz, and Transgaz, is a primary driver of the Romanian stock market. The country’s focus on energy independence and renewable energy investments further enhances this sector’s appeal.

- Banking and Financial Services

- The banking sector, represented by Banca Transilvania and BRD, has been a consistent performer, benefiting from Romania’s economic growth and increased financial inclusion.

- Technology

- Although smaller compared to energy and banking, Romania’s growing tech industry is gradually making its presence felt on the stock market, with potential for further expansion.

- Utilities

- Companies like Electrica play a vital role in the Romanian market, attracting investors seeking stability and consistent returns.

Noteworthy IPOs and New Entrants

- Hidroelectrica IPO (2023)

- The most notable IPO in recent years was Hidroelectrica, a state-owned hydropower producer. Its public listing was Romania’s largest IPO to date, raising significant capital and further strengthening the country’s capital markets.

- Agribusiness Sector

- Companies from Romania’s growing agribusiness sector, such as Holde Agri Invest, have also entered the market, reflecting the diversification of listed industries.

- Technology Startups

- Romania’s burgeoning tech scene has led to smaller tech companies considering or executing listings, signaling the sector’s potential to drive market innovation.

The Romanian Stock Market is anchored by well-established giants in the energy and banking sectors, with increasing diversification into technology and agribusiness. Recent high-profile IPOs like Hidroelectrica highlight the market’s growth and attractiveness, while the emergence of new entrants reflects the country’s evolving economic landscape.

Economic and Political Influences in Romania

Economic Situation and Its Impact on the Stock Market

- Steady Economic Growth

- Romania’s economy has shown resilience in recent years, with consistent GDP growth fueled by strong domestic consumption, export-driven manufacturing, and EU-funded infrastructure projects. This economic stability has created a favorable environment for corporate earnings and stock market performance.

- Inflation and Interest Rates

- Inflation has been a significant factor, with elevated rates impacting consumer spending and corporate margins. However, the central bank’s monetary policies, including measured interest rate adjustments, have helped manage economic stability, indirectly supporting investor confidence.

- EU Funds and Investments

- Romania’s access to substantial EU funding under the Recovery and Resilience Facility has boosted investments in infrastructure and green energy, positively affecting related sectors on the stock market, such as energy, utilities, and construction.

- Rising Retail Investor Participation

- An increase in domestic investor participation has been driven by growing awareness of capital markets and a desire for inflation-hedged investments. This trend has contributed to enhanced liquidity and diversified the investor base.

Role of Government Policies and Reforms

- Privatization and IPOs

- Government-led privatization initiatives, such as the successful IPO of Hidroelectrica, have brought transparency and growth to the stock market. These reforms have also broadened market offerings, attracting both domestic and international investors.

- Regulatory Modernization

- Reforms aimed at aligning Romania’s capital markets with EU standards have improved market efficiency and investor protection. This includes enhanced corporate governance regulations and the adoption of international accounting practices.

- Taxation Policies

- Favorable tax incentives for capital market investments, such as reduced taxes on dividends and capital gains, have encouraged investment activity. However, occasional political discussions about increasing fiscal pressures could impact future sentiment.

- Support for Green Transition

- Policies promoting renewable energy and sustainability have spurred investments in the energy and utilities sectors, positioning Romania as a leader in green energy within the region.

Geopolitical Factors Influencing Investor Sentiment

- Proximity to Ukraine Conflict

- The ongoing conflict in Ukraine has created some uncertainty for investors in the region, though Romania’s position as a NATO member and EU ally has provided relative political stability. The conflict has also accelerated Romania’s role as an energy hub, particularly in natural gas and renewables.

- European Union Relations

- Romania’s integration into the European Union has been a stabilizing force, with access to funding and trade networks enhancing investor confidence. Continued adherence to EU policies strengthens its position as an attractive emerging market.

- Regional Leadership in Energy

- Geopolitical shifts in energy supply chains, including Romania’s increased role in securing energy independence for the region, have made the energy sector particularly appealing to investors.

- Political Stability

- While Romania occasionally experiences internal political turbulence, the broader trajectory of pro-EU and market-friendly policies has maintained a stable environment for capital markets.

Romania’s economic resilience, coupled with strategic government reforms and geopolitical positioning, has created a favorable environment for stock market growth. While challenges such as inflation and regional tensions remain, the country’s progress in infrastructure, green energy, and market modernization positions it as an increasingly attractive destination for investors.

Investment Opportunities in the Market

Most Attractive Sectors for Investors

- Energy and Utilities

- The energy sector is a cornerstone of the Romanian market, led by companies like OMV Petrom, Romgaz, and Hidroelectrica. With Romania’s focus on energy independence and renewable energy investments, the sector offers strong growth potential, particularly in hydropower, natural gas, and green energy technologies.

- Utility companies like Electrica are also appealing for their stability and consistent dividend payouts, making them ideal for long-term investors.

- Banking and Financial Services

- Romania’s growing economy supports a robust banking sector, with major players like Banca Transilvania and BRD showing strong profitability. Increased financial inclusion and rising credit demand further enhance the sector’s prospects.

- Technology

- Although still in its early stages, Romania’s tech sector is rapidly expanding, driven by the country’s reputation as a hub for IT and software development. The potential for future IPOs in this sector presents opportunities for high-growth investments.

- Agribusiness

- Romania’s vast agricultural resources and strategic location make agribusiness a promising sector. Companies like Holde Agri Invest offer exposure to this area, which benefits from EU funding and increasing global food demand.

- Real Estate and Construction

- The real estate sector has seen consistent growth due to urbanization and infrastructure development funded by the EU Recovery and Resilience Facility. This provides opportunities for investors looking for exposure to real assets.

Potential Risks and Rewards

Rewards:

- High Dividend Yields: Romanian companies, especially in energy and utilities, are known for paying substantial dividends, making the market attractive for income-focused investors.

- Growth Potential: As an emerging market, Romania offers significant growth opportunities compared to mature Western European markets.

- Diversification: Exposure to Romania provides a unique diversification opportunity, particularly in sectors like energy and agribusiness that are less correlated with global market trends.

Risks:

- Economic Volatility: While Romania has shown resilience, it remains susceptible to global economic challenges, including inflation, currency fluctuations, and trade disruptions.

- Political Uncertainty: Occasional political instability or unexpected policy changes can affect market confidence.

- Liquidity Risks: Despite growing participation, the market can still experience lower liquidity compared to larger European markets, which may affect entry and exit strategies for investors.

- Geopolitical Tensions: Proximity to the Ukraine conflict and other regional issues could impact investor sentiment.

Accessibility for Foreign Investors

- Regulatory Environment

- Romania has made significant strides in aligning its capital market regulations with European Union standards, ensuring transparency and investor protection. This has made the market more accessible to international investors.

- Foreign Investor Participation

- The upgrade to emerging market status by FTSE Russell has facilitated the entry of institutional investors, improving liquidity and broadening market access.

- Brokerage Services

- A wide range of local and international brokers provide access to the Romanian market, offering platforms that support foreign investors with research, trading tools, and customer service.

- Currency and Tax Considerations

- Investments are denominated in Romanian leu (RON), so investors must consider currency exchange risks. Additionally, Romania offers competitive tax rates on dividends and capital gains, which are relatively attractive compared to other European markets.

- Ease of Investment

- Most foreign investors can access the market without significant restrictions. Clearing and settlement processes are efficient, and international investors can leverage Romania’s inclusion in global indices to integrate it into their portfolios.

Romania offers a compelling mix of growth potential and stability across key sectors like energy, banking, and agribusiness. While there are risks associated with investing in an emerging market, the rewards, including high dividends, market diversification, and opportunities in underexplored sectors, make it an attractive destination for foreign investors. With its improving accessibility and alignment with global standards, Romania continues to solidify its position as a promising investment hub in Eastern Europe.

Trends and Future Outlook

Emerging Trends in the Romanian Stock Market

- Renewable Energy and Green Investments

- The energy transition is a significant trend, with Romania focusing on renewable energy projects. Companies like Hidroelectrica are leading this transition, attracting both institutional and retail investors interested in green energy initiatives.

- Increased Retail Investor Participation

- The number of retail investors in Romania has grown significantly in recent years, driven by improved financial literacy, the rise of digital trading platforms, and the attractiveness of dividend-paying companies.

- Technological Advancements

- The adoption of digital trading platforms and automation in stock market operations has made trading more accessible. Blockchain technology and fintech integration are also on the rise, potentially improving transparency and efficiency.

- Sectoral Diversification

- While energy and banking dominate, sectors like agribusiness, real estate, and technology are gaining traction, diversifying investment opportunities within the market.

- Focus on Dividend Returns

- Romanian companies are known for their high dividend payouts, and this trend is expected to continue, attracting income-focused investors.

- Cross-Border Collaboration

- Partnerships with other European exchanges, such as the ROTX index (a collaboration with the Vienna Stock Exchange), are enhancing Romania’s integration into international capital markets.

Adapting to Global Changes: ESG Initiatives

- ESG Adoption

- Romanian companies are increasingly integrating Environmental, Social, and Governance (ESG) principles into their operations, driven by investor demand and EU regulations. Companies in the energy and utility sectors, like OMV Petrom and Electrica, are leading this shift by focusing on sustainability and cleaner energy.

- Green Financing

- Green bonds and sustainable financing options are gaining popularity. These instruments are aligned with EU climate goals and are expected to drive investments into renewable energy projects and sustainable infrastructure.

- Corporate Transparency

- Improved corporate governance standards are being adopted, aligning with international best practices. This has increased foreign investor confidence and made Romanian companies more competitive in global markets.

- Regulatory Push

- The EU’s focus on sustainability and green initiatives is influencing Romanian market regulations, ensuring companies disclose ESG-related information and align with broader European environmental goals.

Analysts’ Predictions for the Future

- Strong Growth Potential

- Analysts expect continued growth in the Romanian stock market, driven by the country’s economic recovery, increased foreign investment, and the development of strategic sectors like renewable energy and technology.

- Attracting Institutional Investors

- The market’s reclassification to emerging market status has already attracted institutional investors. As liquidity and market maturity improve further, more foreign funds are likely to flow into Romania.

- Energy Sector Dominance

- The energy sector is expected to remain a key driver, especially with Romania’s focus on energy independence and renewable energy projects. Companies like Hidroelectrica are poised for long-term growth.

- Digital Transformation

- The increasing adoption of digital trading platforms and fintech solutions is expected to attract younger, tech-savvy investors, further boosting market participation and liquidity.

- Dividend Stability

- High dividend yields will continue to make the Romanian market attractive, particularly for long-term investors seeking stable income.

- Geopolitical and Economic Resilience

- Despite regional tensions, Romania’s NATO and EU memberships provide a level of stability that analysts believe will mitigate risks and support consistent market growth.

The market is on a promising trajectory, driven by trends like renewable energy investments, ESG integration, and increasing retail and institutional participation. While challenges such as economic volatility and geopolitical risks persist, the market’s alignment with global standards and focus on sustainability position it for strong long-term growth. Analysts remain optimistic about Romania’s role as a key emerging market in the European region.

Comparison with Other Markets

How Does the Romania Stock Market Compare with Neighboring Countries?

- Market Size and Liquidity

- Compared to Poland’s Warsaw Stock Exchange (WSE), the largest and most developed stock exchange in Central and Eastern Europe (CEE), the Bucharest Stock Exchange (BVB) is smaller in terms of market capitalization and trading volumes.

- Romania’s stock market is more comparable to Hungary’s Budapest Stock Exchange (BSE), although Hungary benefits from a strong presence of multinational corporations, whereas Romania has a broader focus on domestic players and energy companies.

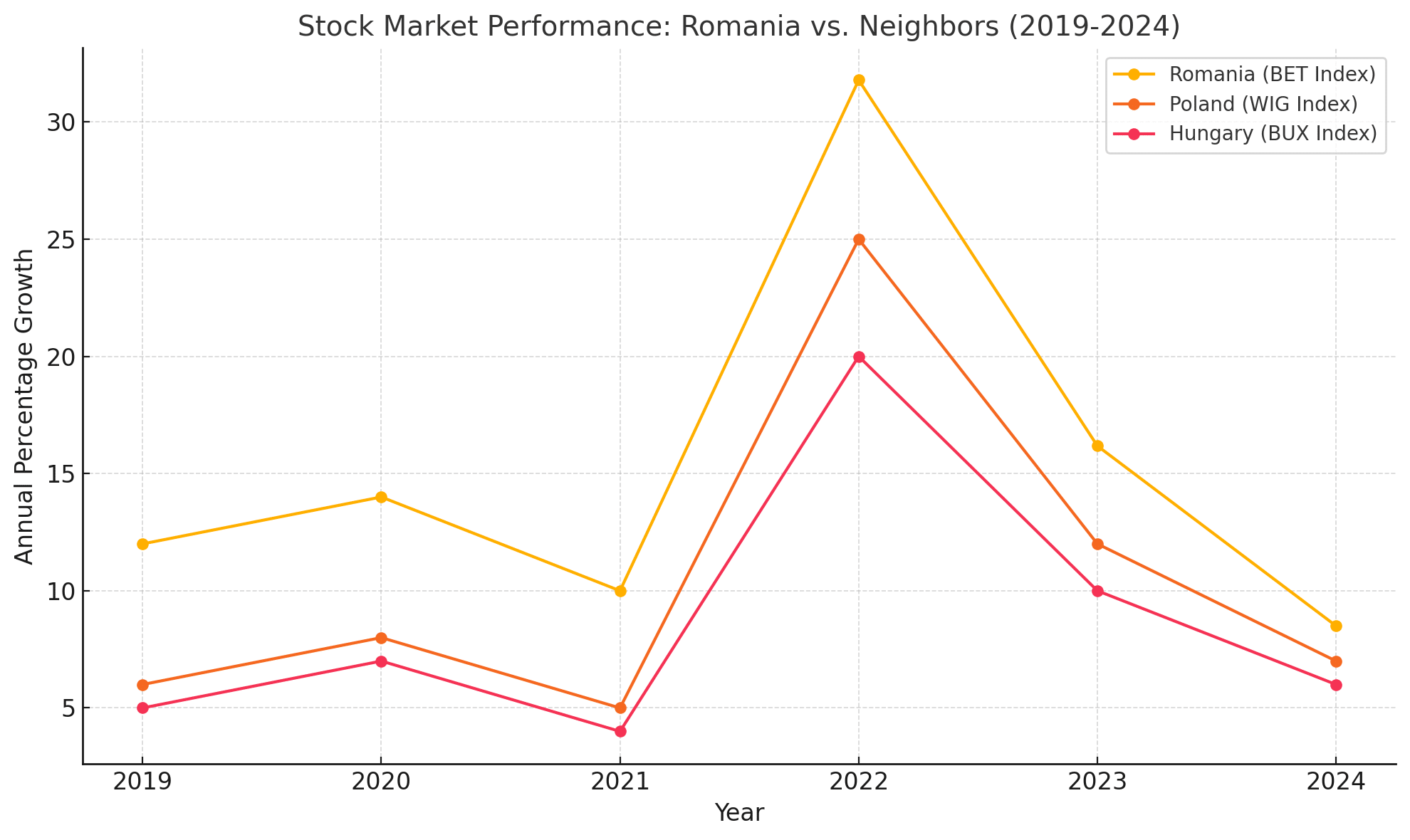

- Performance

- Over recent years, Romania’s BET index has often outperformed indices like Poland’s WIG20 or Hungary’s BUX in terms of percentage growth, largely due to the high dividends and strategic investments in energy and green initiatives.

- Sectoral Composition

- The Romanian market is heavily dominated by energy and utilities, with companies like OMV Petrom and Hidroelectrica leading the charge. In contrast:

- Poland’s market leans more on financial services, technology, and consumer goods.

- Hungary’s market includes more pharmaceutical and industrial firms such as Richter Gedeon and MOL Group.

- Romania’s strategic role in energy supply within the region sets it apart, particularly amid Europe’s push for energy independence.

- The Romanian market is heavily dominated by energy and utilities, with companies like OMV Petrom and Hidroelectrica leading the charge. In contrast:

- Investor Base

- Poland has a more developed institutional investor base, attracting significant foreign capital due to its larger size and liquidity. Romania, while growing, still relies heavily on domestic retail and institutional investors but is increasingly drawing foreign interest since its upgrade to emerging market status.

The chart above illustrates the annual percentage growth of the Romanian Market (BET Index) compared to its regional neighbors, Poland (WIG Index) and Hungary (BUX Index), from 2019 to 2024. Romania demonstrates notable outperformance in certain years, particularly in 2023, highlighting its strong market momentum and appeal as an emerging market.

Frontier Market or Emerging Market?

- Romania is classified as an emerging market by FTSE Russell since 2020.

- Why Emerging Market?

- This status reflects its growing market liquidity, improved accessibility for foreign investors, and adherence to international regulatory standards.

- The inclusion of Romanian companies in global indices like the FTSE Emerging Markets Index has boosted visibility and attracted institutional investors.

- While Romania has left its frontier market classification behind, it is still in the early stages of emerging market maturity compared to larger players like Poland.

What Sets Romania Apart in Terms of Investment Potential?

- High Dividend Yields

- Romanian companies are known for their generous dividend payouts, particularly in the energy and utility sectors. This makes the market especially appealing for income-focused investors.

- Strategic Role in Energy

- Romania’s abundant natural resources and investments in renewable energy, such as hydropower through Hidroelectrica, position it as a critical player in Europe’s energy landscape.

- Growth Potential

- As a smaller market transitioning from frontier to emerging status, Romania offers higher growth potential compared to more mature markets in the region like Poland.

- EU Membership and Funding

- Access to substantial EU funds under the Recovery and Resilience Facility provides a steady pipeline of investments in infrastructure, green energy, and technology, boosting sectors directly tied to the stock market.

- Retail Investor Growth

- The rapid increase in retail investor participation is a unique feature, driven by rising financial literacy and the expansion of digital trading platforms.

- Geopolitical Stability

- Romania benefits from relative geopolitical stability due to its NATO and EU memberships, making it more attractive than other frontier or emerging markets with higher political risks.

While smaller and less liquid than neighboring Poland’s market, the Romanian Stock Market offers unique advantages such as high dividend yields, a dominant energy sector, and robust growth potential. Its emerging market status, strategic importance in regional energy supply, and EU-aligned development trajectory make it an increasingly attractive destination for investors seeking opportunities in Central and Eastern Europe.

Practical Information for Investors

Platforms and Brokers for Trading Romanian Stocks

- Local Brokers

- Several Romanian brokerage firms provide direct access to the Bucharest Stock Exchange (BVB), including:

- TradeVille: One of the leading online trading platforms for Romanian stocks, popular among retail investors.

- BT Capital Partners: The investment banking arm of Banca Transilvania, offering comprehensive brokerage services.

- BRK Financial Group: A prominent Romanian brokerage offering tools for stock trading and analysis.

- Several Romanian brokerage firms provide direct access to the Bucharest Stock Exchange (BVB), including:

- International Brokers

- Some international brokers provide access to the Romanian market, typically for institutional investors or high-net-worth individuals:

- Interactive Brokers: Offers access to multiple markets, including Romania, for both retail and institutional investors.

- Saxo Bank: Provides access to Romanian stocks alongside global markets, ideal for international investors.

- Some international brokers provide access to the Romanian market, typically for institutional investors or high-net-worth individuals:

- Trading Platforms

- Romanian brokers often provide proprietary trading platforms or use globally recognized platforms like MetaTrader or web-based interfaces tailored for ease of use.

- Indirect Investment Options

- Investors who prefer not to trade directly on the BVB can consider exchange-traded funds (ETFs) or mutual funds that include Romanian equities as part of a broader Central and Eastern Europe portfolio.

Regulatory Considerations and Tax Implications

- Regulations

- The Romanian stock market is regulated by the Financial Supervisory Authority (ASF), ensuring transparency, investor protection, and adherence to EU financial standards.

- Foreign investors typically face no major restrictions, though some sectors, like defense or energy, may have additional scrutiny for foreign investments.

- Tax Implications

- Dividends: Subject to a tax rate of 8% for both domestic and foreign investors. Double taxation treaties between Romania and other countries can reduce this rate for foreign investors.

- Capital Gains: Taxed at 10%, but deductions may apply for certain holding periods or under international tax treaties.

- Withholding Taxes: Foreign investors may need to submit documentation to benefit from reduced withholding tax rates under bilateral treaties.

- Currency Considerations

- Stocks are traded in Romanian Leu (RON). Investors should account for exchange rate fluctuations when trading or repatriating profits.

Tips and Strategies for Investing in the Market

- Diversify Across Sectors

- While the energy and banking sectors dominate the market, consider diversifying into emerging sectors like technology, agribusiness, or real estate for balanced risk exposure.

- Focus on Dividend-Paying Stocks

- Take advantage of Romania’s reputation for high dividend yields, especially in energy and utilities, for consistent income.

- Monitor Macroeconomic Indicators

- Stay informed about Romania’s GDP growth, inflation rates, and EU funding initiatives, as these factors directly impact market performance.

- Leverage ETFs and Mutual Funds

- For international investors who want exposure without direct market involvement, investing in funds that track the BET index or broader Eastern European markets can be an efficient strategy.

- Engage with Local Expertise

- Collaborate with local brokers or analysts to understand market nuances, regulatory updates, and upcoming opportunities, such as IPOs or policy-driven growth sectors.

- Consider Long-Term Potential

- While Romania’s market can experience short-term volatility, its long-term prospects, particularly in energy and green initiatives, make it a compelling choice for patient investors.

- Stay Updated on Geopolitical Risks

- Given its regional location, keep an eye on geopolitical developments that could influence market sentiment or sector performance, particularly in energy and infrastructure.

Investing in the Romanian stock market offers unique opportunities, especially for those interested in high-dividend sectors, emerging growth areas, and regional energy leadership. By selecting the right brokers, understanding tax implications, and adopting diversified investment strategies, investors can capitalize on Romania’s growing role in the Central and Eastern European financial landscape.

For more detailed information about the regulations, visit the official Bucharest Stock Exchange (BVB) website: www.bvb.ro.

Conclusion: Romania Stock Market Overview

Key Points Summary

- The Stock Market, anchored by the Bucharest Stock Exchange (BVB), is a growing force in the Central and Eastern European (CEE) financial landscape.

- Its upgrade to emerging market status by FTSE Russell in 2020 reflects its progress in liquidity, regulatory alignment, and investor accessibility.

- Dominated by key sectors such as energy, banking, and utilities, the market also shows potential in technology, agribusiness, and real estate.

- High dividend yields, strategic investments in renewable energy, and increased foreign investor participation are significant attractions.

- Retail participation is on the rise, supported by digital platforms and increasing financial literacy.

Why It’s a Compelling Market for Investment

- High Dividend Payouts: Romanian companies, particularly in energy and utilities, offer some of the highest dividend yields in the region, appealing to income-focused investors.

- Emerging Market Status: Romania’s reclassification has enhanced visibility, attracting institutional investors and increasing market liquidity.

- Strategic Energy Sector: The country’s role in Europe’s energy independence and its investments in renewable energy position it as a key player in the region.

- EU Funding and Infrastructure Development: Access to EU Recovery and Resilience Facility funds bolsters growth in infrastructure, green energy, and technology sectors, driving economic and market expansion.

- Economic Stability: Consistent GDP growth and alignment with EU standards create a stable and predictable environment for investors.

Growth Potential and Challenges

Growth Potential:

- The Romanian stock market is well-positioned for long-term growth, supported by EU integration, increasing investor participation, and sectoral diversification.

- The green transition, led by companies like Hidroelectrica, presents vast opportunities in renewable energy and sustainability-driven sectors.

- Improved access for international investors and digitalization are expected to further enhance market participation and efficiency.

Challenges:

- Market Size and Liquidity: As a relatively small market, Romania still lacks the depth and trading volumes of larger markets like Poland, which can pose challenges for large-scale institutional investors.

- Geopolitical Risks: Regional tensions, particularly the ongoing Ukraine conflict, may affect investor sentiment, though Romania’s NATO and EU memberships provide a degree of stability.

- Economic Volatility: Inflationary pressures and global economic uncertainty could impact corporate earnings and investor confidence.

- Regulatory Adjustments: While progress has been made, further alignment with international standards is necessary to fully unlock Romania’s market potential.

Final Assessment

The Romania Stock Market represents a unique opportunity for investors seeking high dividends, exposure to emerging markets, and participation in the green energy transition. While challenges like liquidity and geopolitical risks exist, the market’s strategic position, favorable economic outlook, and growing investor base position it as a compelling investment destination within the CEE region. With continued reforms and sectoral growth, Romania has the potential to become a key player among Europe’s emerging markets.