Norwegian stocks 2025

The Norway stock market stands as a cornerstone of the nation’s robust economy, offering a wealth of opportunities for investors. Anchored by the Oslo Stock Exchange (OSE), it plays a pivotal role in the global financial ecosystem, particularly in the energy and sustainability sectors. The Norway stock market index provides a vital gauge of the market’s performance, reflecting the strength and resilience of its diverse industries.

Renowned for its stability, the Norway stock market has attracted investors worldwide due to its balanced mix of traditional sectors, like oil and gas, and its expanding focus on renewable energy and technology. Whether you’re a seasoned investor or just starting, the market offers a dynamic landscape filled with potential. In this review, we’ll delve into its key features, major stocks, and comparisons with neighboring markets to provide a clear picture of why the Norway stock exchange continues to thrive.

Overview of the Norway Stock Market

The Norway stock market is a vital component of the Norwegian economy, reflecting the country’s economic strength and industrial expertise. It serves as a key platform for businesses to raise capital and for investors to participate in the growth of leading industries. The market is well-integrated into the global financial system, underpinned by Norway’s strong economic fundamentals and a forward-looking approach to sustainability.

At the heart of the Norway stock market lies the Oslo Stock Exchange (OSE), the primary exchange where equities, bonds, and other financial instruments are traded. Established in 1819, the OSE has grown into a hub for energy companies, particularly those in the oil and gas sectors, while also embracing new opportunities in green technology. The exchange is known for its transparency, reliability, and alignment with global trading standards.

The Norway stock market index, such as the OBX Index, acts as a benchmark for market performance, tracking the most actively traded stocks. These indices provide insights into economic trends, investor confidence, and sectoral growth, offering a comprehensive snapshot of the market’s trajectory.

Key Characteristics of the Norway Stock Exchange

The Norway stock exchange is characterized by its well-regulated framework, which ensures investor protection and market stability. The exchange operates under the oversight of Norway’s financial authorities, adhering to stringent regulatory standards. This fosters confidence among domestic and international investors.

Energy Dominance

The Norway stock market is deeply influenced by the country’s position as a global energy leader. Companies like Equinor ASA play a significant role, with oil and gas contributing significantly to the exchange’s activity. Despite this, Norway has made significant strides in diversifying its energy portfolio to include renewable sources, reflecting a global push toward sustainability.

Diversification into Green Energy and Technology

While energy remains central, the Norway stock exchange is increasingly becoming a hub for companies focusing on green energy and innovative technologies. This shift aligns with Norway’s commitment to reducing carbon emissions and supporting sustainable business practices. The rise of clean energy firms and technology startups has added a new dimension to the exchange, attracting environmentally conscious investors.

Unique Features of the Norway Stock Exchange

- Strong Focus on Sustainability: Norway’s stock exchange stands out for its emphasis on environmental, social, and governance (ESG) criteria, making it a preferred choice for ethical investors.

- Access to Energy Expertise: The OSE provides unparalleled access to a wide range of energy-related investments, from traditional fossil fuels to cutting-edge renewables.

- Global Integration: Its alignment with international trading standards ensures seamless participation for foreign investors.

The blend of traditional energy strengths and a modern approach to innovation positions the Norway stock market as a compelling destination for diverse investment opportunities.

Major Stocks Listed on the Norway Stock Market

The Norway stock market is home to several influential companies that play a critical role in shaping the nation’s economy and contributing to the performance of the Norway stock market index. Here are three prominent stocks that stand out for their market relevance and investor appeal:

1. Equinor ASA (Energy)

Equinor ASA is a global energy company and one of the most significant players on the Oslo Stock Exchange. As Norway’s largest oil and gas producer, it has been a cornerstone of the country’s economy for decades.

- Performance: Equinor consistently delivers strong financial results, driven by its expertise in offshore oil and gas exploration. It has also taken bold steps into renewable energy, particularly offshore wind projects, positioning itself as a leader in the energy transition.

- Relevance: As a major component of the Norway stock market index, Equinor reflects the dominance of the energy sector in the market. Its diversification into green energy has enhanced its appeal to ESG-conscious investors.

2. DNB ASA (Financial Services)

DNB ASA is Norway’s largest financial services group, providing a wide range of banking, insurance, and investment solutions. Its robust presence in both retail and corporate banking makes it a vital player in the Norwegian economy.

- Performance: DNB has shown resilience in the face of economic fluctuations, benefiting from its diversified portfolio and strong risk management practices. The bank’s consistent profitability and dividend payouts have made it a favorite among income-focused investors.

- Relevance: As a key representative of the financial sector, DNB significantly influences the Norway stock market index, showcasing the market’s stability and its role in supporting economic growth.

3. Telenor ASA (Telecommunications)

Telenor ASA is a leading telecommunications company, providing mobile, broadband, and digital services across Norway and other international markets. With a strong focus on innovation, Telenor remains a driving force in the tech and communication sectors.

- Performance: The company has maintained steady growth through its extensive reach and customer-centric services. Telenor’s expansion into emerging markets has opened new revenue streams, enhancing its global footprint.

- Relevance: As a representative of the telecommunications sector, Telenor’s inclusion in the Norway stock market index highlights the market’s diversification and its contribution to the digital economy.

These three stocks not only dominate their respective sectors but also provide a clear picture of the Norway stock market’s dynamic nature. Their performance directly impacts investor sentiment and the overall trajectory of the Norway stock market index, making them essential components of the country’s financial landscape.

Comparative Analysis: Norway Stock Market vs. Similar Countries

- Sweden: Highlight similarities in strong Nordic economies and differences in technology sector dominance.

- Denmark: Compare their focus on renewable energy and pharmaceutical industries.

- Finland: Discuss contrasts in market size and diversification.

Performance of the Norway Stock Market Index

The Norway stock market index serves as a crucial barometer for tracking market trends, reflecting the performance of the most actively traded companies on the Oslo Stock Exchange. By consolidating the movements of its constituents, the index provides a comprehensive snapshot of the market’s health and investor sentiment.

How the Norway Stock Market Index Tracks Trends

The index monitors price fluctuations and trading volumes of top companies, offering insights into economic conditions and sector-specific developments. It includes representatives from key industries such as energy, financial services, telecommunications, and emerging green technologies, making it a well-rounded indicator of the overall market.

- Market Sentiment: As a benchmark, the index captures investor confidence, reacting to global economic events, geopolitical developments, and changes in commodity prices, particularly oil and gas.

- Sector Influence: With energy playing a dominant role in Norway’s economy, the index is often influenced by oil price movements and advancements in renewable energy projects.

Recent Trends and Notable Movements

The Norway stock market index has demonstrated resilience in the face of global economic challenges, supported by the country’s strong fiscal policies and well-performing sectors. Key trends include:

- Energy Sector Growth: Rising oil prices in recent years have bolstered energy stocks, particularly those of Equinor ASA, driving upward momentum in the index.

- Green Energy Shift: Increased focus on renewable energy investments has added diversity to the index, attracting ESG-focused investors. Companies venturing into wind power and clean technologies are becoming more prominent contributors.

- Post-Pandemic Recovery: The index rebounded strongly after the global pandemic, reflecting recovery in consumer demand and industrial activity.

- Financial Stability: Stocks like DNB ASA have benefited from stable interest rates and a robust financial environment, supporting the index’s steady growth.

Key Takeaway

The Norway stock market index continues to showcase the resilience and adaptability of the Norwegian economy. By tracking major market trends and responding to global and local developments, the index remains a valuable tool for understanding market dynamics and guiding investor decisions. Whether influenced by energy markets, technological advancements, or financial sector stability, the index provides a clear picture of Norway’s economic trajectory.

Why the Norwegian Stock Market Matters

The Norwegian stock market is a vital part of the global financial ecosystem, offering diverse investment opportunities. Its emphasis on sustainability and innovation positions it as a key player in future economic trends.

Key Takeaways

- Diverse opportunities in traditional and green industries.

- Strong global influence, driven by integration with international markets.

- Strategic insights via tools like the OBX Index aid in informed decision-making.

Staying informed about the Norwegian stock market is essential for leveraging its strengths and navigating risks effectively, making it an ideal landscape for both seasoned and novice investors.

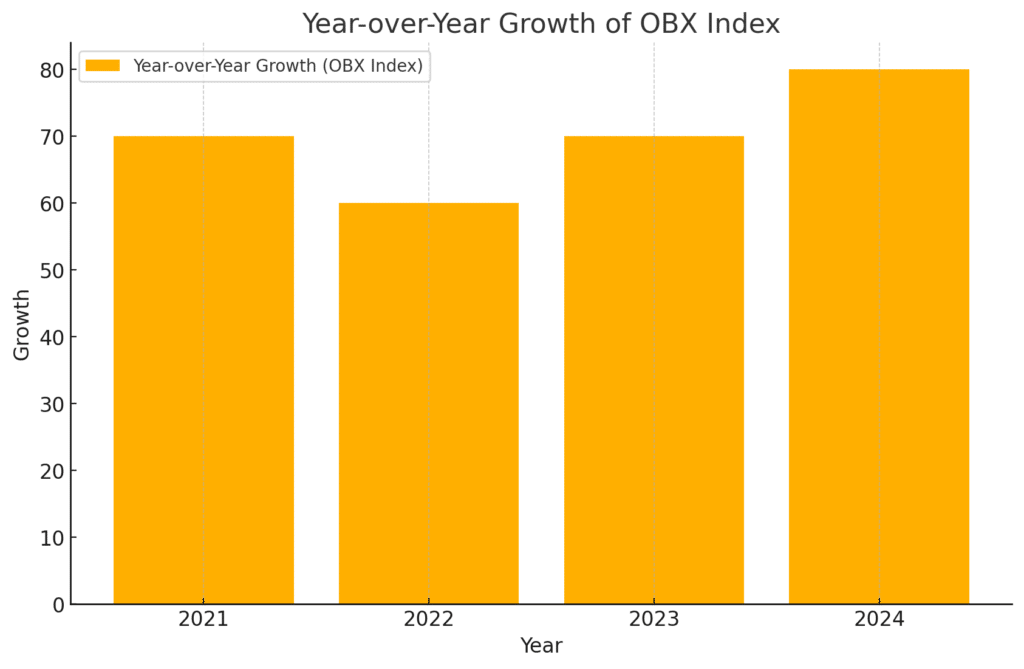

Here are the visualizations for Key Performance Indicators and Recent Trends:

- Historical Performance of OBX Index (2020-2024):

This line graph illustrates the year-over-year growth of the OBX Index, showcasing the steady upward trend in the Norwegian stock market. - Trends in Stock Prices for Major Industries (2020-2024):

This chart compares the Energy and Technology sectors, highlighting the dominance of the Energy sector while reflecting significant growth in Technology. - Year-over-Year Growth of OBX Index:

This bar chart captures the annual growth changes in the OBX Index, making it easier to see which years experienced the most significant increases.

These graphs align with the section’s focus, visually supporting insights into index performance, sectoral trends, and historical growth. Let me know if you’d like further refinements!

Why Invest in the Norway Stock Exchange?

The Norway stock exchange, led by the Oslo Stock Exchange, offers a unique blend of opportunities for both domestic and international investors. Its strategic positioning in key sectors like energy, financial services, and telecommunications, coupled with an increasing focus on green energy and sustainability, makes it a compelling choice for investment. Here are some of the key reasons to consider investing in the Norway stock market:

1. Exposure to Green Energy Growth

Norway has established itself as a global leader in the transition to renewable energy. Companies listed on the Norway stock exchange are pioneering advancements in:

- Offshore wind energy projects

- Hydropower developments

- Carbon capture and storage technologies

These initiatives align with the global push toward sustainable energy solutions, offering investors a chance to be part of the future of clean energy while potentially reaping significant returns.

2. Market Stability and Strong Governance

The Norway stock market is renowned for its stability and transparency.

- Regulatory Oversight: The market operates under a robust regulatory framework that ensures investor protection and fosters trust.

- Economic Stability: Backed by Norway’s strong economy and substantial sovereign wealth fund, the market is insulated against extreme volatility, providing a safer environment for investments.

3. High-Quality Dividend-Paying Companies

Norwegian companies are known for their strong dividend policies, appealing to income-focused investors.

- Stocks like Equinor ASA and DNB ASA consistently offer attractive dividend yields, reflecting their solid financial health.

- These dividends not only provide regular income but also signal the stability and profitability of the companies.

4. Opportunities in a Diversified Economy

While energy dominates, the Norway stock exchange is also home to thriving industries such as:

- Telecommunications: Companies like Telenor ASA are leaders in innovation and digital connectivity.

- Financial Services: The banking and financial sector offers stability and growth potential, driven by sound fiscal policies.

5. Commitment to Sustainable Growth Initiatives

Norway is at the forefront of ESG (Environmental, Social, and Governance) investing. Companies listed on the exchange prioritize sustainability, making the market attractive to investors who value ethical and responsible investments.

Key Takeaway

Investing in the Norway stock exchange provides a unique opportunity to balance stability and growth. With its strong dividend-paying companies, exposure to green energy, and commitment to sustainable practices, the market is well-suited for long-term investors looking to diversify their portfolios while contributing to a more sustainable future. Whether you’re interested in traditional energy or emerging green technologies, the Norway stock market offers something for everyone.

Final words

The Norway stock market stands out as a robust and dynamic investment hub, offering a blend of traditional strengths and forward-looking opportunities. Anchored by the Oslo Stock Exchange, the market reflects Norway’s economic resilience and its strategic focus on industries like energy, financial services, and telecommunications. The Norway stock market index provides valuable insights into market trends, showcasing the performance of its leading companies and the growing influence of green energy initiatives.

For investors, the Norway stock exchange offers:

- Exposure to innovative green energy projects.

- Stability backed by strong governance and a resilient economy.

- Attractive dividend-paying stocks with long-term growth potential.

However, as with any investment, it’s essential to understand the risks, including global market volatility and sector-specific challenges, particularly in energy. By taking a balanced approach, investors can unlock the opportunities presented by this thriving market while mitigating potential downsides.

The Norway stock market continues to evolve, blending its rich industrial heritage with a commitment to sustainable growth. Whether you’re an experienced investor or exploring international markets for the first time, Norway offers a unique landscape worth considering for your portfolio.