Introduction to the Bolivia Stock Market

The Bolivia stock market plays a pivotal role in the nation’s economy, serving as a platform for raising capital, fostering economic growth, and supporting the development of key sectors. Though relatively smaller compared to regional giants like Argentina and Brazil, Bolivia’s stock market is an essential component of its financial ecosystem, reflecting the country’s economic resilience and growth potential.

As a resource-driven economy, Bolivia’s stock market often mirrors the performance of industries like mining, agriculture, and energy, which are vital to its GDP. The market provides a gateway for businesses to secure funding, expand operations, and drive innovation, ultimately benefiting the country’s broader economic framework. For global investors, the Bolivia stock market presents a unique opportunity to diversify portfolios by tapping into an emerging economy with significant potential for growth.

Understanding Bolivia’s stock market is not only crucial for those investing locally but also for anyone looking to gain insights into the broader Latin American economic landscape. Its connections to neighboring markets, such as the Argentina stock exchange and the Brazil stock market, create a dynamic interplay of regional economic trends, offering valuable opportunities for informed investors. By exploring Bolivia’s stock market, investors can uncover untapped potential while gaining exposure to one of Latin America’s most intriguing emerging markets.

Overview of the Bolivia Stock Market

The Bolivia stock market operates as a smaller yet vital component of the country’s financial infrastructure, providing businesses and investors with opportunities to raise capital and trade securities. Despite its modest size compared to regional powerhouses like Brazil and Argentina, the Bolivian market offers unique characteristics that make it a noteworthy player in Latin America.

Structure and Regulation

The Bolivia stock market is primarily centered around the Bolivian Stock Exchange (Bolsa Boliviana de Valores, BBV), headquartered in La Paz. The BBV facilitates the trading of various financial instruments, including equities, bonds, and other securities. It operates under the regulation of the Autoridad de Supervisión del Sistema Financiero (ASFI), the financial supervisory authority responsible for ensuring transparency, fairness, and stability in the market.

The Bolivia stock index, which tracks the performance of listed securities, serves as a benchmark for investors to gauge market trends and economic health. This index reflects the activities of key sectors such as mining, energy, and agriculture, which dominate the Bolivian economy.

Key Players

The main participants in the Bolivia stock market include:

- Local Companies: Mining firms, energy providers, and agricultural companies are among the most prominent issuers of securities.

- Institutional Investors: Pension funds and banks play a significant role in the market, offering liquidity and stability.

- Retail Investors: While participation from individual investors is growing, it remains limited compared to more developed markets.

- Foreign Investors: Although not as active as in neighboring countries, foreign interest in Bolivia stocks is gradually increasing, especially in resource-related industries.

Unique Features

What sets the Bolivia stock market apart is its focus on resource-driven industries. Bolivia is rich in natural resources, including lithium, silver, and natural gas, which positions the stock market as a gateway for investors seeking exposure to these global commodities. Additionally, the market’s relatively low correlation with larger international indices offers an opportunity for diversification.

Another distinguishing feature is its gradual but steady growth in investor participation and technological advancements. Efforts to modernize trading platforms and improve market accessibility have made it easier for investors to engage with Bolivia stocks.

Comparison with Regional Markets

Compared to the Argentina stock exchange and the Brazil stock market, Bolivia’s stock market is smaller in scale and liquidity. However, its strategic focus on resource-based industries and its untapped potential make it a compelling option for investors looking to explore emerging markets in Latin America.

In summary, the Bolivia stock market is a dynamic yet underexplored financial hub that reflects the country’s economic priorities and growth potential. Understanding its structure, key players, and unique features provides valuable insights for anyone interested in investing in Bolivia stocks or navigating the broader Latin American financial landscape.

Key Indices and Performance Metrics of the Bolivia Stock Market

The Bolivia stock index serves as a vital benchmark for tracking the performance of the nation’s stock market. These indices reflect the health and trends of the market, offering insights into economic activity and guiding both local and foreign investors in making informed decisions.

Major Stock Indices in Bolivia

The primary stock index in Bolivia is the Índice General de la Bolsa Boliviana de Valores (IGBBV), managed by the Bolivian Stock Exchange (Bolsa Boliviana de Valores, BBV). The IGBBV is designed to measure the overall performance of the market by tracking a basket of prominent securities listed on the exchange.

- Índice General de la Bolsa Boliviana de Valores (IGBBV): This index comprises a weighted average of selected stocks that represent key sectors in the Bolivian economy, including mining, energy, finance, and agriculture. It serves as the primary gauge for market trends and investor sentiment.

Historical Performance

The Bolivia stock index has shown moderate but steady growth over the years, reflecting the gradual development of the country’s economy and capital markets. Historically, the index has been influenced by several factors:

- Resource Dependency: Fluctuations in global commodity prices, particularly in natural gas and mining products, have significantly impacted index performance.

- Economic Policies: Government policies promoting infrastructure development and foreign investment have contributed to market growth.

- Global Market Trends: While relatively insulated from global market volatility, major economic shifts, such as the 2008 financial crisis and the COVID-19 pandemic, have left their mark on the index.

In recent years, the IGBBV has exhibited resilience, with sectors like mining and agriculture driving performance. The country’s strategic position as a significant player in the lithium market has also generated increased interest in its stocks.

Current Performance and Trends

The current trends in the Bolivia stock index indicate a focus on sustainability and modernization:

- Mining and Energy: With Bolivia holding some of the world’s largest lithium reserves, companies in this sector are poised for growth, attracting both local and international investors.

- Agriculture and Exports: As a key sector in the economy, agriculture contributes to the stability of the index.

- Infrastructure Projects: Ongoing government initiatives in infrastructure development have bolstered the performance of construction and related industries.

Relevance for Tracking Economic Trends

The Bolivia stock index is a crucial tool for monitoring the nation’s economic health. Its performance serves as a barometer for the broader economy, reflecting the strength of key industries and investor confidence. For policymakers and analysts, the index provides valuable insights into economic trends, while for investors, it highlights opportunities for growth and diversification.

In conclusion, the Bolivia stock index not only tracks the performance of the market but also mirrors the country’s economic evolution. Understanding its dynamics and historical trends is essential for anyone looking to engage with the Bolivian stock market or assess the broader economic outlook of this emerging Latin American economy.

Opportunities and Challenges for Investors in the Bolivia Stock Market

Investing in the Bolivia stock market offers unique opportunities for diversification and exposure to an emerging economy rich in natural resources. However, like any investment, it comes with its own set of risks and challenges. A balanced understanding of both can help investors make informed decisions.

Opportunities in the Bolivia Stock Market

- Resource-Driven Growth

Bolivia is endowed with vast natural resources, particularly lithium, silver, and natural gas. Companies in these sectors, listed as Bolivia stocks, present lucrative opportunities for investors looking to capitalize on the global demand for commodities. Lithium, in particular, is a high-growth area due to its critical role in battery technology and electric vehicles. - Strategic Position in Latin America

Bolivia’s geographic location and trade relationships with neighboring countries like Argentina and Brazil enhance its economic prospects. The Bolivia stock market provides a gateway for investors seeking exposure to the broader Latin American market. - Developing Infrastructure and Renewable Energy

Government investments in infrastructure and renewable energy projects create opportunities in sectors such as construction, engineering, and utilities. These initiatives are expected to drive economic growth and attract both domestic and foreign investors. - Emerging Market Potential

As a relatively untapped market, Bolivia offers potential for long-term growth. Lower market correlation with developed economies makes Bolivia stocks attractive for portfolio diversification.

Challenges in the Bolivia Stock Market

- Political and Economic Risks

Political instability and policy uncertainty have historically affected investor confidence in Bolivia. Changes in government or shifts in economic policies can impact the stability of the Bolivia stock market. - Market Liquidity

One of the significant challenges for investors is the limited liquidity in the Bolivia stock market. With fewer listed companies and lower trading volumes compared to larger regional markets like Brazil or Argentina, entering and exiting positions can be difficult. - Regulatory and Transparency Issues

The regulatory framework, while improving, still presents hurdles for investors. Concerns about transparency and the enforcement of regulations can deter some foreign investors from engaging with Bolivia stocks. - Dependence on Global Commodity Prices

The Bolivian economy, and by extension its stock market, is heavily reliant on commodity exports. Fluctuations in global prices for resources like natural gas or metals can significantly impact the performance of the Bolivia stock market. - Limited Foreign Investment Access

While opportunities exist, foreign investors often face restrictions or additional layers of complexity when trying to invest in Bolivia stocks, such as currency controls and tax considerations.

Balancing Opportunities and Risks

Investing in Bolivia requires a long-term perspective and careful evaluation of risks. Diversification across thriving sectors like mining, agriculture, and energy can help mitigate potential downsides. Meanwhile, staying informed about political and regulatory changes is crucial for managing risks.

For investors willing to navigate these challenges, the Bolivia stock market offers untapped potential in an emerging economy poised for growth. By balancing opportunities with a thorough understanding of risks, investors can position themselves to benefit from Bolivia’s economic development and market expansion.

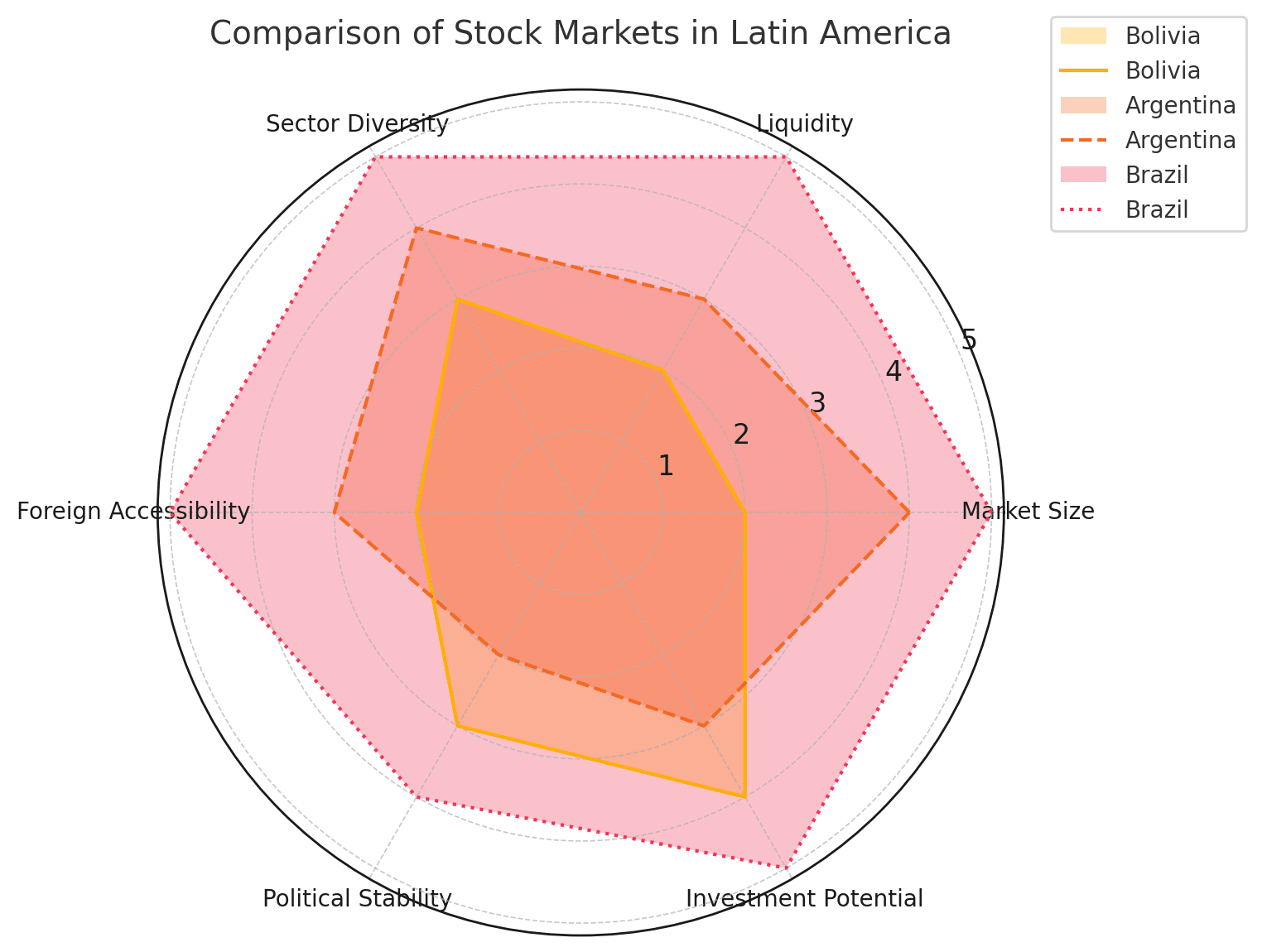

Comparing Regional Markets: Bolivia, Brazil, and Argentina

The Bolivia stock market, Argentina stock exchange, and Brazil stock market are key components of Latin America’s financial landscape. Each offers distinct characteristics in terms of market size, sectors, and investor accessibility, making them valuable for different types of investors. Here’s a comparative analysis:

Market Size

- Bolivia Stock Market

- The Bolivia stock market is one of the smallest in the region, with limited trading volumes and fewer listed companies. Its size reflects Bolivia’s developing economy and the dominance of small-to-medium enterprises over large corporations.

- Argentina Stock Exchange (BYMA)

- Argentina’s market is considerably larger than Bolivia’s, with a broader range of sectors and higher trading volumes. The Buenos Aires Stock Exchange (BYMA) lists major players in industries like agriculture, finance, and energy, which are key drivers of Argentina’s economy.

- Brazil Stock Market (B3)

- Brazil hosts the largest stock market in Latin America, the B3 (Brasil Bolsa Balcão). The Brazil stock index, such as the Ibovespa, represents some of the region’s most prominent companies in finance, energy, and technology. With significant liquidity and a wide range of listed securities, the Brazil stock market is a global investment hub.

Dominant Sectors

- Bolivia Stock Market

- The Bolivian economy is heavily reliant on natural resources, with sectors like mining (lithium, silver) and energy (natural gas) dominating its stock market. Agriculture also plays a significant role.

- Argentina Stock Exchange

- Agriculture and agro-industrial products are major contributors to the Argentine market, along with energy (oil and gas), finance, and consumer goods. Argentina’s economy benefits from its export-driven industries, reflected in the stock exchange’s sectoral diversity.

- Brazil Stock Market

- The Brazilian market is more diversified, with strong representation in finance, energy (oil and biofuels), technology, consumer goods, and agriculture. Companies like Petrobras and Vale dominate the Brazil stocks listed on the NYSE and B3.

Investor Accessibility

- Bolivia Stock Market

- Accessibility for foreign investors is relatively limited. Challenges include a lack of liquidity, fewer listed companies, and regulatory hurdles. However, ongoing modernization efforts aim to attract more foreign participation.

- Argentina Stock Exchange

- The Argentina stock market is more open to foreign investors, particularly through American Depositary Receipts (ADRs) and Argentina stocks on the NYSE. However, economic volatility and currency risks are significant concerns.

- Brazil Stock Market

- Brazil’s stock market is the most accessible to international investors, offering a wide range of options, including Brazil stocks on the NYSE and robust participation from institutional investors. Its advanced trading infrastructure and regulatory environment make it attractive for global investment.

Similarities

- All three markets are influenced by commodity prices, with natural resources playing a significant role in their economies.

- Each market offers exposure to emerging market growth, appealing to investors seeking high-risk, high-reward opportunities.

- Political and economic instability is a shared challenge, affecting investor confidence across the region.

Key Differences

| Feature | Bolivia Stock Market | Argentina Stock Exchange | Brazil Stock Market |

|---|---|---|---|

| Market Size | Small, fewer listed companies | Medium, broader range of sectors | Largest in Latin America |

| Dominant Sectors | Mining, energy, agriculture | Agriculture, energy, finance | Finance, energy, technology |

| Liquidity | Limited | Moderate | High |

| Foreign Accessibility | Low | Moderate | High |

Conclusion

The Bolivia stock market is an emerging player in Latin America, offering niche opportunities in natural resources but facing challenges in size and liquidity. The Argentina stock exchange provides broader sectoral exposure but is hindered by economic instability. The Brazil stock market, with its size, liquidity, and accessibility, stands out as the most robust and diversified option for investors.

Each market offers unique advantages and risks, making them complementary options for those looking to diversify across Latin America’s dynamic economies.

How to Invest in Bolivia’s Stock Market: A Step-by-Step Guide

Investing in the Bolivia stock market can provide exposure to an emerging economy with potential for growth in sectors like mining, agriculture, and energy. While the process may differ from more developed markets, it is straightforward with proper preparation. Here’s a step-by-step guide:

1. Understand the Bolivia Stock Market

Before diving in, it’s essential to familiarize yourself with how the Bolivia stock market operates:

- The primary exchange is the Bolivian Stock Exchange (Bolsa Boliviana de Valores, BBV).

- Key sectors include mining, energy, and agriculture, with a focus on natural resources like lithium and natural gas.

- The market is regulated by the Autoridad de Supervisión del Sistema Financiero (ASFI), ensuring compliance and transparency.

2. Choose a Broker

To access Bolivia stocks, you’ll need to work with a licensed broker. Brokers provide the platform and tools for buying and selling securities on the BBV.

- Look for brokers registered with the BBV and regulated by ASFI.

- Ensure the broker offers services tailored to your needs, such as access to research, online trading platforms, and customer support.

3. Open an Investment Account

Once you’ve selected a broker, you’ll need to open an account. The process typically involves:

- Providing Personal Information: Submit identification documents (passport or national ID), proof of residence, and tax information.

- Depositing Funds: Fund your account using local currency (Bolivianos) or an accepted international currency, depending on the broker’s requirements.

- Meeting Minimum Investment Requirements: Some brokers may have minimum investment thresholds, so check these details before opening an account.

4. Understand Regulations and Tax Implications

Investors, especially international ones, should be aware of Bolivia’s regulatory framework and tax obligations:

- Foreign Investor Access: While foreign investors are allowed, the market may pose challenges such as currency conversion and repatriation of funds.

- Capital Gains Tax: Understand the local tax implications for profits earned from investing in Bolivia stocks.

- Currency Risks: Be mindful of fluctuations in the Boliviano if you’re investing in foreign currencies.

5. Research Investment Opportunities

Perform due diligence before making any investment. Key considerations include:

- Sector Performance: Focus on thriving sectors like mining and energy, which dominate the Bolivia stock market.

- Company Fundamentals: Analyze the financial health, management, and growth prospects of the companies you plan to invest in.

- Market Trends: Keep an eye on the performance of the Bolivia stock index, which tracks the overall health of the market.

6. Make Your First Investment

After completing the preparatory steps, you’re ready to start investing:

- Place Orders: Use your broker’s platform to place buy or sell orders for specific Bolivia stocks.

- Diversify Your Portfolio: Consider spreading your investments across various sectors to mitigate risks.

- Monitor Performance: Regularly review the performance of your investments and adjust your strategy as needed.

7. Stay Informed and Updated

The Bolivia stock market is influenced by global commodity prices, local economic policies, and political developments. Staying updated on these factors will help you make better investment decisions:

- Follow market news and updates from the BBV.

- Monitor global trends affecting Bolivia’s key sectors, such as lithium demand or natural gas prices.

- Network with local and regional financial experts for additional insights.

8. Consult a Financial Advisor

If you’re new to investing in emerging markets, consider consulting a financial advisor familiar with Bolivia. They can provide guidance on navigating the local market, managing risks, and achieving your investment goals.

Investing in the Bolivia stock market offers opportunities to tap into a resource-rich economy with growth potential. By understanding the market, choosing the right broker, and staying informed, you can make the most of these opportunities. Whether you’re a local or international investor, the journey starts with proper research and preparation.

Bolivia in the Context of Latin American Markets

The Bolivia stock market occupies a unique position in Latin America, offering niche opportunities in resource-driven sectors within an emerging economy. While it is smaller in size and less liquid compared to regional powerhouses like the Brazil stock market and the Argentina stock exchange, Bolivia’s market plays an integral role in the region’s broader economic and financial ecosystem.

Bolivia’s Niche in the Regional Market

Bolivia’s economy is heavily reliant on natural resources, particularly mining (lithium and silver), natural gas, and agriculture. These sectors form the backbone of the Bolivia stock market, attracting investors looking for exposure to commodities essential for global industries, such as electric vehicles and energy.

Unlike Brazil and Argentina, which offer more diversified and mature markets, Bolivia provides a focused investment landscape with opportunities tied to global trends in sustainable energy and commodity demand.

Interaction with Larger Markets

- Trade Relationships and Economic Integration

- Bolivia’s strong trade ties with Brazil and Argentina influence its stock market performance. As one of the main suppliers of natural gas to its neighbors, Bolivia’s energy sector is closely linked to the economic health of these larger markets.

- Regional trade agreements, such as Mercosur (of which Bolivia is an associate member), foster economic interdependence and create opportunities for cross-border investments.

- Influence of Brazil’s Market

- The Brazil stock market (B3) is the largest in Latin America and a key driver of regional economic trends. While Bolivia’s stock market is less directly correlated with Brazil’s, the performance of Brazil’s energy and agriculture sectors can impact investor sentiment toward Bolivia stocks, particularly in related industries.

- Comparison with Argentina’s Market

- The Argentina stock exchange (BYMA) is more developed and diversified than Bolivia’s, with a broader range of listed companies. However, both markets face challenges such as political volatility and reliance on commodity exports. For investors, Bolivia may appear as a less complex alternative to Argentina, with fewer regulatory barriers and a smaller scale.

Trends and Opportunities

- The Rise of Lithium

Bolivia’s massive lithium reserves place it at the center of Latin America’s strategic importance in the global energy transition. As demand for lithium surges, Bolivia’s stock market stands to benefit from increased foreign investment and growth in mining companies. - Infrastructure Development

Ongoing infrastructure projects in Bolivia, often funded by partnerships with regional neighbors, present opportunities for growth in construction and related sectors. - Emerging Market Diversification

For investors focused on Latin America, Bolivia offers diversification away from the heavily traded Brazil stocks or the more volatile Argentine market. Bolivia’s smaller scale and niche focus can complement investments in these larger markets.

Challenges in a Regional Context

- Market Size and Liquidity

Bolivia’s market size pales in comparison to Brazil and Argentina, limiting its appeal to institutional investors. Low liquidity can make it challenging to execute large trades without affecting prices. - Political and Economic Risks

Similar to its neighbors, Bolivia faces political and economic risks that can deter investors. However, its relatively stable regulatory environment provides a slight edge over Argentina’s market. - Limited Foreign Participation

Unlike Brazil, which has extensive foreign investor access and Brazil stocks listed on the NYSE, Bolivia’s stock market has yet to attract significant international attention. Overcoming this limitation is essential for long-term growth.

Bolivia’s Potential in Latin America

While Bolivia may not rival the size or liquidity of the Brazil stock market or the diversity of the Argentina stock exchange, it holds unique potential as a resource-rich emerging market. With the global shift toward renewable energy and sustainable commodities, Bolivia is well-positioned to capitalize on its lithium reserves and natural resource wealth. For investors seeking exposure to these trends within a Latin American context, the Bolivia stock market offers a promising yet underexplored opportunity.

By understanding Bolivia’s role within the broader Latin American markets, investors can make more informed decisions and leverage its strengths as part of a diversified regional portfolio.

The Potential of Bolivia’s Stock Market

The Bolivia stock market is a unique and emerging player in Latin America, offering niche opportunities for investors seeking exposure to resource-rich sectors such as mining, energy, and agriculture. While it may not rival the size or liquidity of regional giants like Brazil or Argentina, Bolivia’s market provides an alternative pathway for those looking to diversify their portfolios and tap into the growth potential of an underexplored economy.

As global demand for commodities like lithium continues to rise, Bolivia stocks are poised to gain prominence, particularly in the context of the energy transition and sustainable development. Coupled with government efforts to modernize financial infrastructure and attract foreign investment, Bolivia’s market holds significant promise for those willing to navigate its challenges.

Investing in the Bolivia stock market requires a balanced approach, considering both its opportunities and inherent risks, such as limited liquidity and political uncertainties. However, for investors with a long-term perspective, Bolivia presents a compelling case as an emerging investment hub in Latin America.

If you’re interested in exploring the opportunities offered by the Bolivia stock market, now is the time to research, engage with trusted financial advisors, and consider the untapped potential of this dynamic economy. By doing so, you can position yourself at the forefront of a market that is steadily evolving and ready for growth.