An Introduction to the Australian Stock Market: A Guide for Investors

The Australian stock market, centered around the Australian Securities Exchange (ASX), is a vital component of the nation’s economy. It serves as a platform where businesses raise capital, and investors trade a wide range of securities, including stocks, ETFs, and derivatives. Recognized for its transparency and robust regulatory framework, the stock market in Australia has become a hub for both local and international investors.

Understanding the Australia stock market is crucial for anyone looking to build wealth or diversify their investment portfolio. With its unique blend of domestic and global influences, the stock market Australia offers opportunities across various industries such as mining, technology, and finance.

In this article, we’ll delve deeper into the workings of the Australia stock market today, explore trading strategies, and highlight essential tools for navigating this dynamic financial environment. Whether you’re a beginner or an experienced trader, understanding the intricacies of the stock market in Australia can help you make informed decisions and achieve your investment goals.

Overview of the Stock Market in Australia

The stock market of Australia has a rich history that dates back to the 19th century when regional exchanges first emerged in major cities like Sydney and Melbourne. These independent exchanges laid the groundwork for what would eventually become the Australian Securities Exchange (ASX) in 1987, following the merger of six regional stock exchanges. Today, the ASX is recognized as one of the world’s leading financial marketplaces, known for its advanced technology and stringent regulatory standards.

As the central hub of the live stock market Australia, the ASX facilitates the trading of various financial instruments, including stocks, bonds, ETFs, and derivatives. It plays a pivotal role in connecting businesses with investors, enabling companies to raise capital while offering individuals and institutions opportunities to grow their wealth.

The Australia stock market index serves as a barometer for the country’s economic health, reflecting the performance of key industries such as mining, banking, and technology. Notable indices include the ASX 200, which tracks the top 200 companies listed on the exchange. These indices not only guide investors but also attract significant international interest due to Australia’s strong economic ties with global markets.

The stock market of Australia is a cornerstone of the nation’s economy, driving innovation, creating jobs, and fostering economic growth. Its development over the years highlights the resilience and adaptability of Australia’s financial ecosystem, making it a critical area for both domestic and international investors to watch closely.

How the Australian Stock Market Works

The Australian stock market operates primarily through the Australian Securities Exchange (ASX), a sophisticated and transparent platform designed to facilitate efficient trading. Understanding the mechanics of stock market trading in Australia is essential for investors aiming to navigate this dynamic marketplace effectively.

How Trading Works on the ASX

Trading on the ASX occurs in an electronic and highly regulated environment, ensuring fair and orderly transactions. Buyers and sellers place orders through brokers or trading platforms, which are matched automatically based on price and volume. The market operates on a price-time priority system, where orders are executed according to the best price and the time they were entered.

Types of Securities Available for Trading

The ASX offers a diverse range of securities, catering to the varying needs of investors. These include:

- Stocks: Shares of ownership in listed companies.

- ETFs (Exchange-Traded Funds): Investment funds that track indices, commodities, or other assets.

- Derivatives: Financial instruments like options and futures, used for hedging or speculative purposes.

- Bonds and Fixed Income Products: Low-risk options for generating steady returns.

Stock Market Trading Hours in Australia

The Australia stock market trading hours are designed to align with global markets while accommodating domestic investors. The ASX operates on the following schedule:

- Pre-Market (7:00 AM – 10:00 AM AEST): Order placement and adjustments.

- Main Trading Session (10:00 AM – 4:00 PM AEST): Active trading period where most transactions occur.

- After-Hours (4:10 PM – 6:50 PM AEST): Settlement and processing of trades.

Being aware of stock market opening times in Australia helps investors plan their strategies effectively, especially when coordinating with global markets like the US or Europe.

The seamless and regulated nature of stock market trading in Australia ensures a reliable environment for investors. From trading diverse securities to leveraging optimal Australia stock market trading hours, the ASX provides a robust framework for achieving financial goals.

Stock Market News and Trends

The Australian stock market is a dynamic environment influenced by local developments and global economic conditions. Staying updated with the latest stock market news in Australia is essential for making informed investment decisions and capitalizing on emerging opportunities.

Current Trends in the Australian Stock Market

Recent trends in the Australia stock market reflect a strong focus on technology, renewable energy, and mining. The rise of tech startups and increased investment in green energy have provided growth opportunities beyond traditional industries like banking and resources. Meanwhile, sectors such as mining continue to dominate, supported by global demand for commodities.

Today’s stock market in Australia shows an increased interest in ESG (Environmental, Social, and Governance) investments, with many investors prioritizing sustainable and socially responsible portfolios. Additionally, the ASX has seen significant retail investor participation, fueled by user-friendly trading platforms and low-cost brokerage options.

Global Influence on the Australian Stock Market

The stock market in Australia is highly interconnected with global markets. For instance, fluctuations in the US market often influence investor sentiment in Australia, given the time zone differences. A common question, “when does the US stock market open in Australia?” is crucial for traders tracking international trends. The US market typically opens at 1:30 AM AEST during Daylight Saving Time, aligning with major economic announcements and influencing today’s stock market in Australia.

Recent Stock Market News and Its Impact on Australia

Recent stock market news today in Australia highlights volatility due to global economic uncertainties, including inflation fears, interest rate hikes, and geopolitical tensions. Events like a stock market crash in Australia, though rare, often stem from these broader influences and emphasize the importance of diversification and risk management.

Despite challenges, positive news, such as record-high performance of certain indices or booming sectors, underscores the resilience of the Australian economy. The ASX 200, for example, remains a key indicator of market health, reflecting investor confidence across leading industries.

By keeping a close eye on stock market news Australia and understanding global and local influences, investors can better navigate the complexities of today’s stock market in Australia, positioning themselves for long-term success.

How to Invest in the Australian Stock Market

Investing in the Australian stock market is a rewarding journey for individuals seeking to build wealth and achieve financial independence. Whether you’re a beginner or an international investor, understanding the steps, tools, and strategies is essential for success.

Step-by-Step Guide for Beginners

- Educate Yourself

Begin by learning the basics of investing, including key terms, how the stock market in Australia operates, and different investment strategies. There are numerous courses, books, and online resources designed for the stock market for beginners in Australia. - Set Your Investment Goals

Determine your financial goals, risk tolerance, and investment horizon. This will guide your choice of assets and strategies. - Choose a Broker

Select a reliable brokerage platform that offers access to the ASX and fits your needs. Many stock market apps in Australia provide user-friendly interfaces, low fees, and valuable research tools for beginners. - Open an Account

Sign up for a trading account with your chosen broker. This typically involves providing identification and completing a KYC (Know Your Customer) process. - Research and Select Investments

Use tools and resources to analyze companies, sectors, and trends. Focus on diversified portfolios to reduce risks, especially if you’re new to the Australia stock market. - Place Your First Trade

Once you’ve identified an investment, place your buy order through your broker. Monitor your portfolio regularly to track its performance.

Recommended Tools and Resources

To enhance your investing experience, leverage the best stock market apps in Australia. These include:

- CommSec: A popular choice for comprehensive tools and market research.

- SelfWealth: Known for its low fees and beginner-friendly interface.

- eToro: Ideal for social trading and international market access.

- Sharesight: Excellent for tracking portfolio performance and tax reporting.

Advice for International Investors

For those outside Australia or looking to diversify globally, there are options for investing in international markets:

- How to Invest in the Indian Stock Market from Australia: Use platforms like Interactive Brokers or Saxo Bank, which provide access to Indian exchanges.

- How to Invest in the US Stock Market from Australia: Many Australian brokers, including Stake and eToro, allow direct access to US stocks.

Key Considerations for International Investing

- Be aware of currency conversion fees and tax implications.

- Stay updated on market hours; for example, the US stock market operates late at night in Australian time zones.

- Research the regulatory environment of the target market to understand risks.

By following these steps and utilizing top resources, even beginners can confidently invest in the stock market in Australia. With the right approach and tools, you’ll be well-equipped to achieve your financial goals in this thriving market.

Challenges and Risks in the Australian Stock Market

Investing in the Australian stock market offers significant opportunities, but it is not without challenges and risks. Understanding these risks and employing strategies to mitigate them is essential for long-term success.

Common Risks for Australian Investors

- Market Volatility

The stock market in Australia can experience short-term fluctuations due to economic conditions, political events, or natural disasters. These swings impact investor confidence and portfolio values. - Sector Concentration

The Australian market is heavily weighted towards sectors like mining and financials. A downturn in these industries can disproportionately affect overall market performance. - Global Influences

Events in international markets, such as interest rate changes in the US, can have ripple effects on the Australia stock market. - Currency Risks

For investors holding foreign assets or relying on international trade, currency fluctuations can erode returns.

Historical Events and Their Impact

Historical stock market crashes in Australia, such as the 1987 Black Monday crash and the 2008 Global Financial Crisis, have underscored the market’s vulnerability to global and local economic pressures. These events led to stricter regulations, more robust risk management practices, and increased investor awareness.

While these crashes caused significant short-term losses, they also shaped the market into a more resilient and transparent system. For instance, the ASX introduced enhanced risk controls and technology upgrades to handle trading volumes during volatile periods.

Strategies to Mitigate Risks

- Diversification

Avoid overexposure to a single sector by diversifying across industries and asset classes. This reduces the impact of a downturn in any one area. - Stay Informed

Regularly review market updates, including stock market forecasts for the next 6 months in Australia. This helps investors anticipate potential risks and adjust strategies accordingly. - Focus on Long-Term Goals

Market volatility can be unsettling, but historical data shows that the average stock market return in Australia has been positive over the long term. Staying committed to long-term investment goals can help weather short-term turbulence. - Use Stop-Loss Orders

Protect your investments by setting stop-loss orders to automatically sell securities if their prices drop below a certain level. - Seek Professional Advice

Consulting with financial advisors or leveraging automated investment tools can provide guidance tailored to individual risk profiles.

By recognizing the risks and implementing these strategies, investors can navigate the Australian stock market with greater confidence. While challenges are inevitable, a well-informed and diversified approach can help achieve consistent returns and minimize potential losses.

Future of the Australian Stock Market

The Australian stock market has long been a cornerstone of the nation’s economy, and its future is shaped by a mix of global economic trends, emerging industries, and technological innovations. As we look toward the next 5-10 years, there are several key factors and growth opportunities that will influence its trajectory.

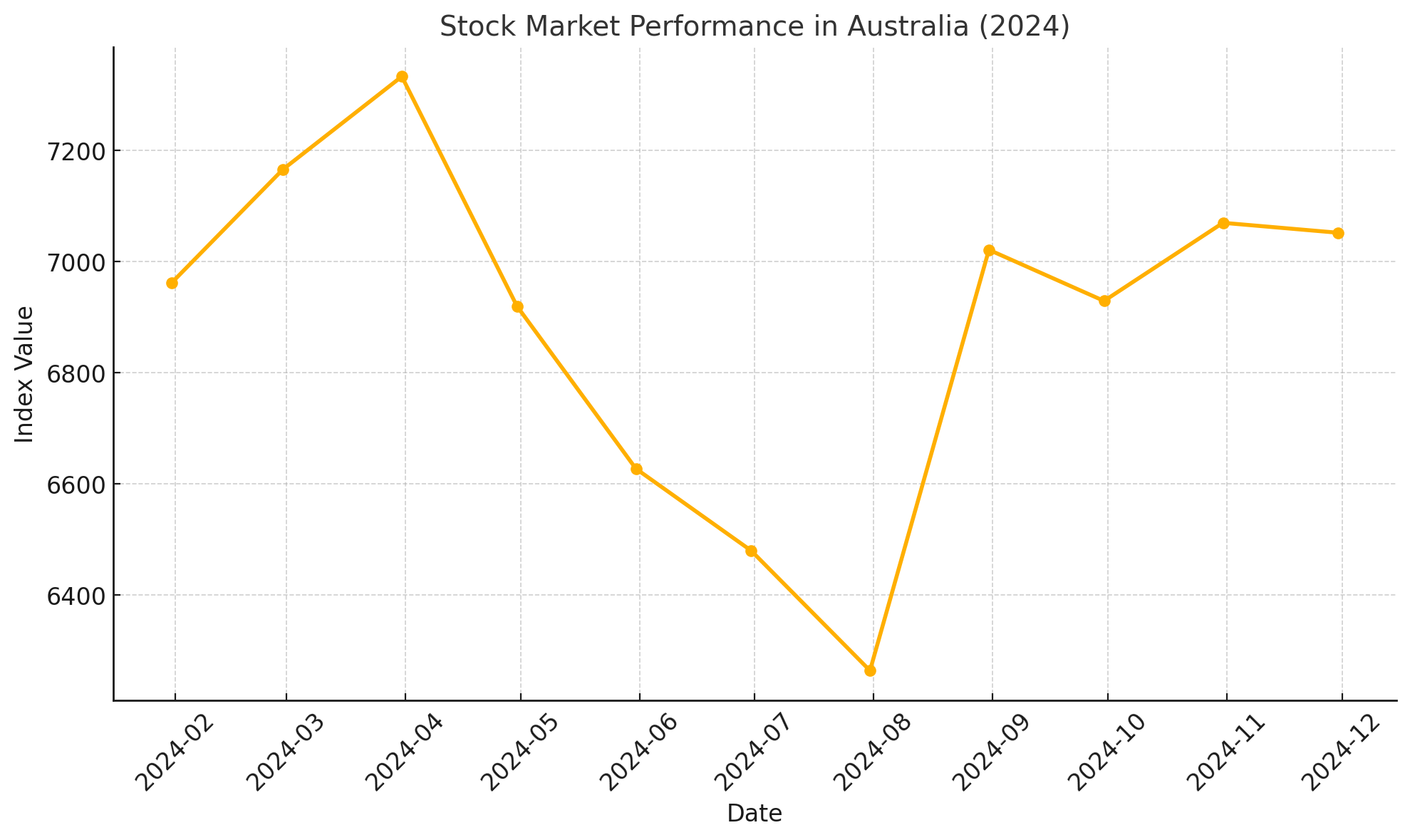

Here is a visualization of the hypothetical Stock Market performance in Australia for 2024. It shows the monthly index values to help track market trends throughout the year.

Predictions for the Next 5-10 Years

In the coming years, the Australia stock market index is expected to continue evolving, driven by both local and global dynamics. Analysts predict steady growth, although influenced by cyclical market conditions, technological advancements, and geopolitical events. Based on the stock market forecast for the next 6 months in Australia, we may see continued volatility, but overall, long-term trends are expected to be positive.

Investor sentiment is likely to be influenced by factors such as inflation rates, interest rates, and consumer spending, which are closely tied to both local economic activity and international trade. The Australian stock market is expected to benefit from a strong economic recovery post-pandemic, with steady economic expansion supported by government policies and global trade.

Growth Opportunities in Emerging Industries

- Technology

The technology sector, particularly in areas such as software development, artificial intelligence, and cybersecurity, is poised for significant growth. Companies in these areas are likely to continue attracting investment as businesses and consumers increasingly rely on digital solutions. Startups in the tech space may drive innovation, and established companies will adapt to meet the growing demand for tech-driven services. - Renewable Energy

As the global push for sustainability intensifies, the renewable energy sector in Australia is gaining momentum. The country’s vast natural resources, including solar and wind power, position it as a leader in clean energy production. Companies involved in renewable energy projects, such as solar energy and electric vehicles, are expected to experience substantial growth, providing new opportunities for investors. - Healthcare and Biotechnology

Advances in healthcare, particularly in biotechnology and pharmaceuticals, are expected to fuel growth in the sector. With an aging population and an increasing focus on healthcare innovation, Australian healthcare companies may offer strong long-term returns, especially in areas like medical research and biotech. - Mining and Commodities

Although the mining sector is already a dominant player in the Australian economy, ongoing demand for minerals, particularly lithium, rare earth elements, and gold, will continue to drive growth. The transition to electric vehicles and renewable energy technologies could further boost demand for critical minerals, presenting new opportunities for Australian miners.

How Global Events Could Shape the Future of the Stock Market in Australia

The Australian stock market does not operate in isolation and is significantly impacted by global events. Changes in global trade policies, international market trends, and geopolitical tensions can have direct and indirect effects on the performance of the ASX. For example, fluctuations in global oil prices, trade disputes, or financial crises can influence investor behavior in Australia.

Further, international interest rates and inflationary pressures, particularly in major economies like the US and China, can affect the Australian dollar and market sentiment. Global events like the ongoing shift towards digital currencies or changes in global supply chains may also present new challenges and opportunities for investors in Australia.

In summary, the stock market in Australia is poised for a future filled with both challenges and exciting growth opportunities. By focusing on emerging industries, staying informed on global trends, and adapting to changing market conditions, investors can position themselves to benefit from the long-term growth of the Australian market.

The official website of the Australian Securities Exchange (ASX) provides comprehensive information on market updates, trading hours, listed companies, and investment resources.

Final words

In this guide, we’ve explored the fundamentals of the Australian stock market, from its history and key players to the types of securities available and how to navigate its complexities. The stock market in Australia offers substantial opportunities for investors, with sectors like technology, renewable energy, and mining paving the way for future growth.

We also highlighted the challenges and risks inherent in investing, such as market volatility and global influences, and offered strategies to mitigate those risks, such as diversification and staying informed about market trends. The stock market forecast for the next 6 months in Australia suggests that while volatility may persist, long-term growth remains a promising outlook, especially in emerging industries.

For anyone looking to invest in the Australia stock market, it’s crucial to stay informed. Regularly following stock market news in Australia can help you understand market dynamics and adjust your strategies accordingly. Using reliable resources, such as stock market apps in Australia, and leveraging expert advice can also enhance your investment decisions.

Ultimately, responsible and informed investing is the key to long-term success. By understanding the risks, embracing opportunities for growth, and staying updated on market news, you can navigate the Australian stock market with confidence and work towards achieving your financial goals.