Introduction

The Argentina stock market serves as a cornerstone of the nation’s financial system, reflecting the economic health and growth potential of one of South America’s largest economies. It provides a platform for companies to raise capital, enabling innovation and expansion while offering investors opportunities to participate in the country’s economic progress. As a dynamic market, it bridges the gap between businesses seeking funding and individuals or institutions looking to grow their wealth.

Understanding the Argentina stock market is essential for investors aiming to make informed decisions. It not only allows access to a diverse range of securities, including equities, bonds, and exchange-traded funds (ETFs), but also offers insights into the economic trends and policies shaping the region. Whether you’re a beginner exploring international investments or a seasoned professional diversifying your portfolio, knowledge of this market can empower you to navigate its opportunities and challenges effectively.

Key Stock Exchanges

Argentina’s stock market operates primarily through two major stock exchanges: the Buenos Aires Stock Exchange (Bolsa de Comercio de Buenos Aires, BCBA) and the MERVAL (Mercado de Valores de Buenos Aires). These exchanges are central to the nation’s trading activities, acting as hubs for buying and selling securities while fostering liquidity and transparency in the financial system.

Buenos Aires Stock Exchange (BCBA)

The BCBA is Argentina’s principal stock exchange, providing a platform for a wide range of securities, including stocks, bonds, and derivatives. It plays a vital role in facilitating corporate fundraising and offering investors a reliable environment to trade. The BCBA’s robust regulatory framework ensures market stability and fair trading practices, attracting both local and international investors.

MERVAL Index

The MERVAL index is the primary benchmark for the Argentina stock market. It tracks the performance of the most actively traded companies listed on the BCBA, offering a snapshot of the market’s overall health and momentum. This index is crucial for investors to gauge market sentiment and identify emerging trends.

S&P Argentina BMI

The S&P Argentina Broad Market Index (BMI) broadens the perspective by including a more extensive range of stocks across sectors. It provides a comprehensive view of the market’s performance, making it a valuable tool for both institutional and individual investors looking to diversify their portfolios.

Together, these exchanges and indices form the backbone of Argentina’s stock market, offering a blend of growth opportunities and insights into the nation’s economic trajectory. Their significance extends beyond facilitating trades; they symbolize the confidence and potential of Argentina’s evolving financial landscape.

Regulatory Framework

The Argentina stock market operates under a robust regulatory framework designed to promote transparency, ensure fair trading practices, and protect investors. At the core of this framework is the Comisión Nacional de Valores (CNV), or the National Securities Commission, which serves as the primary regulatory authority.

The Role of the CNV

The CNV is tasked with overseeing the activities of the stock exchanges and ensuring compliance with the nation’s securities laws. It enforces regulations that safeguard market integrity, such as preventing insider trading, maintaining accurate financial disclosures, and monitoring trading activities to detect irregularities. By fostering a transparent and equitable trading environment, the CNV instills confidence among local and international investors.

Ensuring Market Stability

In addition to its regulatory duties, the CNV plays a pivotal role in maintaining market stability. It implements policies to mitigate risks and respond to economic or financial shocks that could disrupt trading activities. The CNV’s proactive approach to risk management ensures that the stock market remains a reliable platform for investors and businesses alike.

Investor Protection

One of the CNV’s primary goals is to protect investors by promoting education and ensuring that market participants adhere to ethical standards. It also provides a framework for dispute resolution, giving investors avenues to address grievances effectively.

The CNV’s stringent oversight and commitment to fair trading practices are critical in enhancing the credibility of the Argentina stock market. Its efforts contribute significantly to the market’s development, making it an attractive destination for global investors seeking opportunities in South America.

Types of Securities

The Argentina stock market offers a diverse range of securities, catering to investors with varying goals and risk appetites. Understanding these options is key to building a well-rounded investment portfolio. The primary securities traded include stocks, bonds, derivatives, and exchange-traded funds (ETFs), each offering unique opportunities and characteristics.

Stocks

Stocks represent ownership in publicly traded companies listed on the Buenos Aires Stock Exchange (BCBA). These equities provide investors with the potential for capital appreciation and dividends. Argentina’s stock market features companies from sectors such as energy, agriculture, and banking, offering a mix of high-growth opportunities and stable performers.

Opportunities in Stocks:

- High-growth industries like renewable energy and technology.

- Dividend-paying companies for steady income.

- Access to global markets through dual-listed stocks.

Bonds

Bonds are fixed-income securities issued by the government or corporations to raise capital. They are considered a safer investment compared to equities, as they offer regular interest payments and return of principal at maturity. In Argentina, government bonds, such as Bonos del Tesoro (Treasury Bonds), are popular for their stability and relatively predictable returns.

Opportunities in Bonds:

- Government bonds for conservative investors.

- Corporate bonds offering higher yields but increased risk.

- Inflation-linked bonds to hedge against rising prices.

Derivatives

Derivatives, including options and futures, are financial instruments whose value is derived from underlying assets like stocks or indices. They are primarily used for hedging risks or speculative trading. The Argentina stock market offers derivatives linked to major indices like MERVAL, providing advanced investors tools to manage market volatility.

Opportunities in Derivatives:

- Hedging against price fluctuations in stocks or commodities.

- Leveraging positions to maximize potential returns.

- Trading volatility as a strategy in uncertain markets.

Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, offering exposure to a basket of securities. They are an efficient way to diversify investments across multiple sectors or indices with lower transaction costs. ETFs linked to the Argentina stock market allow investors to gain broad exposure to the country’s economic sectors.

Opportunities in ETFs:

- Diversification across industries with a single investment.

- Low-cost entry to Argentina’s stock market.

- Access to global investors seeking exposure to the Argentine economy.

By understanding the unique features and benefits of these securities, investors can tailor their strategies to align with their financial goals. Whether seeking growth, income, or risk management, the Argentina stock market offers a variety of tools to meet diverse investment needs.

Types of Securities

The Argentina stock market provides investors with access to a wide range of financial instruments, allowing them to pursue various investment strategies. The primary securities traded include stocks, bonds, derivatives, and exchange-traded funds (ETFs), each catering to different investment needs and risk preferences.

Stocks

Stocks represent ownership in companies listed on the Buenos Aires Stock Exchange (BCBA). These equities enable investors to benefit from the financial success of the issuing companies through capital gains and dividends. Argentina’s stock market features companies in sectors such as agriculture, banking, energy, and technology.

Opportunities in Stocks:

- Investment in growth-oriented industries like fintech and renewable energy.

- Dividends from stable, established companies.

- Access to dual-listed companies for international exposure.

Bonds

Bonds are fixed-income securities issued by the Argentine government or corporations to raise funds. They are generally lower-risk investments compared to equities, offering periodic interest payments and repayment of principal upon maturity.

Opportunities in Bonds:

- Government bonds provide steady income and reduced risk.

- Corporate bonds offer higher yields for risk-tolerant investors.

- Inflation-indexed bonds hedge against rising inflation.

Derivatives

Derivatives include options, futures, and swaps, derived from underlying assets like stocks or indices. These instruments are widely used for hedging risks and speculative purposes.

Opportunities in Derivatives:

- Risk management through hedging against stock price movements.

- Leveraged trading for higher potential returns.

- Access to index-linked futures for market speculation.

ETFs

ETFs are pooled investment vehicles that track the performance of indices or sectors. They are an efficient and cost-effective way to diversify investments.

Opportunities in ETFs:

- Broad exposure to Argentina’s market with lower fees.

- Diversification across multiple industries and sectors.

- Ideal for beginner investors seeking ease of entry.

Trading Mechanisms

The Argentina stock market operates through a streamlined trading process that ensures efficiency and transparency. Investors can participate using various tools and platforms, making the market accessible to both domestic and international participants.

How Trading Works

Trading in the Argentina stock market follows a set schedule, with clearly defined trading hours. Transactions are executed electronically through the Mercado Abierto Electrónico (MAE) or other trading platforms, ensuring fast and secure operations.

Key Aspects of Trading:

- Trading Hours: Typically align with standard business hours.

- Settlement Process: Trades are settled on a T+2 basis, meaning transactions are finalized two days after execution.

- Market Accessibility: Platforms support trading for both retail and institutional investors.

Platforms and Tools

Modern trading platforms offer intuitive interfaces and robust tools for analyzing market data and executing trades.

Popular Trading Tools:

- MAE (Mercado Abierto Electrónico): The electronic trading platform for securities.

- Brokerage Platforms: Provide access to real-time market data, research tools, and order execution.

- Mobile Trading Apps: Enable investors to trade conveniently on the go.

These mechanisms ensure that trading in the Argentina stock market is efficient, secure, and accessible for investors of all levels.

Major Stocks

The Argentina stock market features several prominent companies that drive market activity and reflect the country’s economic strengths. Here are three leading companies that define the market:

Industry: Energy

YPF is a state-controlled energy company and the largest oil and gas producer in Argentina. Its performance significantly impacts the energy sector and the overall economy. The company’s strategic role in developing Argentina’s natural resources, including shale reserves, makes it a key player in the market.

Grupo Financiero Galicia (GGAL)

Industry: Financial Services

Grupo Financiero Galicia is one of Argentina’s largest private financial institutions. Its extensive banking and credit services have established it as a cornerstone of the financial sector. The company’s stability and consistent growth attract both domestic and foreign investors.

Pampa Energía

Industry: Utilities and Energy

Pampa Energía is a leading utility provider, involved in electricity generation, transmission, and distribution. Its diversified energy portfolio and role in Argentina’s infrastructure development make it a significant market influencer.

Why They’re Influential:

- Represent major sectors of the economy (energy, finance, utilities).

- Consistently traded with high market capitalization.

- Act as barometers for Argentina’s economic health.

These companies not only dominate trading volumes but also symbolize the economic potential and resilience of the Argentina stock market.

Market Performance

The Argentina stock market has experienced significant fluctuations in recent years, influenced by domestic economic challenges and global market conditions. The MERVAL Index, the country’s primary benchmark, has shown a mix of volatility and resilience, reflecting the broader economic trends.

Trends in the MERVAL Index

- Growth Phases: The MERVAL Index has seen periods of strong growth, driven by sectors like energy and finance. Bullish trends often align with favorable commodity prices and foreign investment inflows.

- Volatility: Political uncertainty and inflation have led to sharp corrections at times, underscoring the market’s sensitivity to domestic factors.

- Recent Performance: In 2024, the index has shown a gradual recovery, supported by improved economic policies and increased interest from international investors.

Overall Market Performance

Compared to previous years, the Argentina stock market has demonstrated incremental recovery from the pandemic’s economic impact. However, structural challenges such as inflation and debt concerns continue to weigh on investor sentiment. Despite these hurdles, the market remains attractive for its potential high returns, particularly in sectors tied to global demand, such as agriculture and energy.

Influencing Factors

The performance of the Argentina stock market is shaped by a complex interplay of domestic and global influences. Understanding these factors is crucial for investors aiming to navigate the market effectively.

Domestic Factors

- Economic Policies: Government initiatives, such as fiscal reforms and monetary policies, directly impact investor confidence and market stability.

- Political Stability: Elections and changes in leadership can trigger market volatility, as investors react to policy shifts and uncertainty.

- Inflation and Currency Fluctuations: High inflation rates and a volatile peso significantly affect the valuation of securities and foreign investment flows.

Global Factors

- Commodity Prices: As a major exporter of agricultural products, Argentina’s market is highly sensitive to global prices of soybeans, wheat, and corn.

- Foreign Investment: International capital flows are influenced by global economic conditions, trade agreements, and investor sentiment toward emerging markets.

- Global Trends: Broader trends, such as the rise of ESG investing and shifts in interest rates, also play a role in shaping market dynamics.

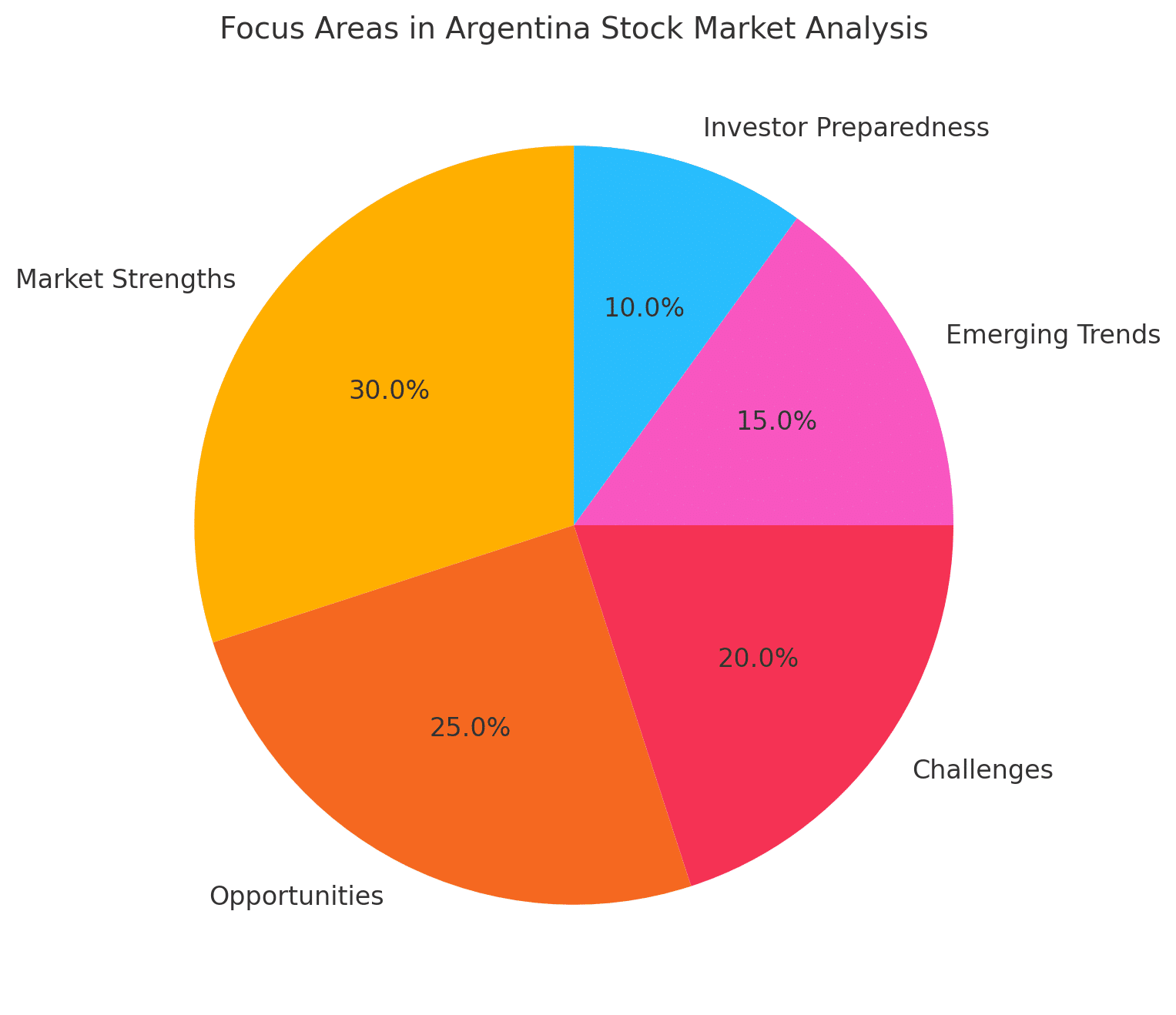

Investment Opportunities

The Argentina stock market offers a variety of investment opportunities across sectors, presenting avenues for growth and diversification.

Promising Sectors

- Energy: Companies like YPF and Pampa Energía are benefiting from the expansion of renewable energy projects and the exploitation of shale reserves in Vaca Muerta.

- Agriculture: Argentina’s role as a global agricultural powerhouse positions companies in this sector for strong performance, especially with rising global food demand.

- Technology: Emerging fintech and tech companies are attracting attention for their innovation and growth potential.

Undervalued Stocks

Investors seeking value can explore companies with strong fundamentals but currently undervalued due to market volatility. These stocks offer potential for significant returns as the economy stabilizes.

Example Opportunities:

- Energy infrastructure development projects.

- Export-oriented agricultural firms.

- Niche technology startups with regional expansion plans.

Risk Management

Investing in the Argentina stock market involves navigating risks associated with volatility, economic instability, and external factors. Implementing robust risk management strategies is essential for long-term success.

Key Strategies

- Diversification: Spread investments across multiple sectors and asset classes to reduce exposure to specific risks.

- Hedging: Use financial instruments like derivatives to protect against adverse price movements in stocks or currency fluctuations.

- Volatility Analysis: Regularly assess market trends and adjust portfolios to align with changing conditions.

Importance of Understanding Volatility

The Argentina stock market is known for its sensitivity to economic and political events. Investors who monitor macroeconomic indicators and remain informed about local and global trends can better anticipate market movements and mitigate risks effectively.

By applying these strategies, investors can navigate the challenges of the Argentina stock market while positioning themselves to capitalize on its opportunities.

Trends and Innovations

The Argentina stock market is embracing global trends and technological advancements, reshaping its landscape to attract a broader range of investors and enhance market efficiency. These innovations reflect the market’s adaptation to modern investment priorities and technologies.

ESG Investing

Environmental, Social, and Governance (ESG) investing is gaining traction in Argentina. Companies focusing on sustainability, ethical governance, and social responsibility are attracting more investors, particularly from international markets where ESG standards are a key consideration.

AI and Algorithmic Trading

Artificial Intelligence (AI) and algorithmic trading tools are increasingly being used to analyze market trends, execute trades, and optimize investment strategies. These technologies are helping institutional and retail investors make data-driven decisions, improving market liquidity and efficiency.

Cryptocurrency and Blockchain

Cryptocurrency adoption is rising in Argentina, driven by the country’s economic challenges, including inflation and currency devaluation. Blockchain technology is also being explored for secure and transparent trading systems, potentially reducing transaction costs and enhancing regulatory compliance.

Challenges

Despite its opportunities, the Argentina stock market faces several challenges that investors must consider before entering.

Economic Uncertainties

- Inflation: Persistent high inflation erodes purchasing power and impacts corporate earnings, leading to market volatility.

- Currency Fluctuations: The devaluation of the Argentine peso creates uncertainty for foreign investors.

- Debt Levels: High public debt can strain economic growth and deter investment.

Regulatory Hurdles

Complex regulations and bureaucratic inefficiencies can pose barriers for businesses and investors. While the CNV works to maintain market integrity, navigating regulatory requirements can be challenging for newcomers.

Market Entry Barriers

- Limited Liquidity: Compared to larger markets, Argentina’s stock market has relatively lower liquidity, which may affect trade execution.

- Political Instability: Frequent policy shifts and political uncertainty can deter long-term investment.

International Comparison

Comparing the Argentina stock market with those of its regional counterparts—Brazil, Mexico, and Chile—offers valuable insights into its unique characteristics and competitive positioning.

Brazil

- Strengths: Brazil boasts a more liquid and diversified market, with a strong emphasis on commodities and a robust derivatives market.

- Comparison: Argentina’s market is smaller but offers niche opportunities in sectors like agriculture and energy.

Mexico

- Strengths: Mexico benefits from closer ties to the U.S., with many of its companies dual-listed on U.S. exchanges.

- Comparison: Argentina provides distinct opportunities tied to its natural resources and local innovation, despite having less integration with global markets.

Chile

- Strengths: Chile’s market is known for stability and a strong focus on mining and finance.

- Comparison: Argentina has higher growth potential but also greater risks, making it suitable for investors seeking higher returns in emerging markets.

Investor Awareness

Education and research are critical for navigating the complexities of the Argentina stock market. By leveraging available resources, investors can make informed decisions and manage risks effectively.

Key Resources

- CNV (National Securities Commission): Provides official information and guidelines for market participants.

- Brokerage Research Reports: Many brokers offer detailed analysis and recommendations tailored to Argentina’s market.

- Financial News Platforms: Local and international financial news outlets keep investors updated on market developments.

- Educational Tools: Online courses, webinars, and investment forums help investors understand the nuances of trading and market dynamics.

Importance of Staying Informed

Regularly monitoring economic indicators, political developments, and global trends is essential for success in the Argentina stock market. Knowledge empowers investors to seize opportunities while mitigating risks in a volatile yet promising market environment.

The Argentina stock market presents a compelling mix of strengths and opportunities for investors willing to navigate its unique challenges. Its rich natural resources, burgeoning energy sector, and growing focus on innovation and technology provide attractive avenues for growth. The country’s leading companies, such as YPF and Grupo Financiero Galicia, highlight its potential as a hub for energy, finance, and agriculture in South America.

However, areas for improvement remain. Economic uncertainties, high inflation, and regulatory complexities can pose challenges for both local and international investors. Addressing these issues through policy stability, increased transparency, and market liquidity would enhance the overall investment environment.

For those who approach it with diligence, the Argentina stock market offers significant rewards. By staying informed, diversifying portfolios, and leveraging emerging trends like ESG investing and AI trading, investors can confidently tap into the market’s potential. With the right strategies, Argentina can be a valuable addition to a well-rounded investment portfolio, offering opportunities to capitalize on the country’s resilience and growth trajectory.