$19 an Hour Is How Much a Year After Taxes? Your Income Explained

Working out your annual income from an hourly wage is a practical step in understanding your financial outlook. If you’re earning $19 an hour, you might be wondering how this translates into yearly income, especially after taxes. This guide will break it down for you, offering a clear calculation and actionable insights for managing your take-home pay.

How Much Money a Year Is $19 an Hour?

To estimate annual income, start by understanding how hourly wages translate into yearly earnings. Here’s a quick breakdown for $19 an hour:

- Hourly Wage: $19

- Work Hours Per Week: 40 (full-time)

- Weeks Per Year: 52

Calculation Before Taxes:

$19 × 40 hours/week × 52 weeks/year = $39,520 per year

This is your gross annual income, which does not account for deductions like taxes or benefits.

How do deductions vary by state?

Deductions from your gross income vary significantly by state due to differences in tax policies and additional factors like cost of living. Here’s a breakdown of how they vary:

1. State Income Taxes

- No State Income Tax States:

Some states, like Texas, Florida, and Nevada, do not impose state income tax. In these states, your deductions for income taxes are limited to federal taxes and other mandatory contributions. - High Income Tax States:

States like California, New York, and Oregon have higher income tax rates, which can significantly reduce your take-home pay. For example:- California: Progressive tax rates up to 13.3%.

- New York: Progressive tax rates up to 10.9%.

2. Local Taxes

- Certain states, like New York and Ohio, also have local taxes in addition to state taxes. For example:

- New York City has an additional income tax for city residents.

- Some municipalities in Ohio impose local income taxes on top of state taxes.

3. Property and Sales Taxes

While not deducted directly from your paycheck, states with lower income tax rates may compensate by having higher property or sales taxes. This affects your disposable income and overall tax burden.

4. Tax Credits and Deductions

- Some states offer unique tax credits or deductions (e.g., credits for renters, education, or renewable energy use) that can reduce your state tax liability.

- States like Colorado offer low flat taxes but may also have fewer credits.

5. Filing Status and Residency

- If you work in one state but live in another, you may have to file taxes in both states, depending on reciprocal agreements. This could impact your overall deductions.

Example of Variation: Comparing Two States

- Florida: No state income tax. A $19/hour wage results in federal taxes and Social Security/Medicare deductions only.

- California: Progressive state income tax can lead to an additional 9% deduction for middle-income earners, reducing take-home pay further.

Key Insights:

- Choose Your State Wisely: Moving to a state with no or low state income taxes can lead to significant savings.

- Understand Local Impacts: Be aware of local taxes or additional deductions in high-tax states.

- Account for Cost of Living: States with no income tax often compensate with higher living expenses in other areas like housing or sales taxes.

If you’re considering a move or assessing take-home pay by state, tools like paycheck calculators or consulting a tax advisor can provide a clearer picture.

What Affects Your Take-Home Pay?

Your take-home pay, or net income, depends on several factors, including:

- Federal Income Taxes

Federal tax rates vary based on your income bracket and filing status (single, married, etc.). Typically, federal taxes range from 10% to 24% for most earners. - State Taxes

Depending on where you live, state tax rates could range from 0% in states like Texas and Florida to over 10% in states like California. - Social Security and Medicare

These mandatory deductions typically account for 7.65% of your gross income. - Other Deductions

These include health insurance, retirement savings (401k), and other benefits.

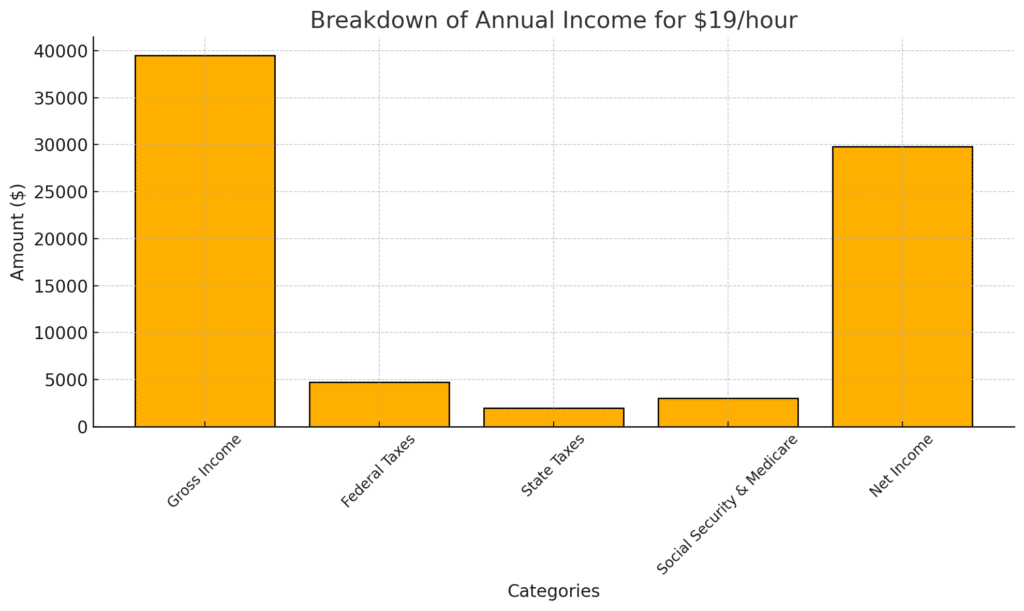

$19 an Hour After Taxes: An Example Calculation

Let’s break down an estimated post-tax income for a $19 hourly wage:

- Gross Annual Income: $39,520

- Estimated Federal Tax (12%): $4,742

- State Tax (Assume 5%): $1,976

- Social Security & Medicare (7.65%): $3,022

Net Income:

$39,520 – $4,742 – $1,976 – $3,022 = $29,780 per year

This equals approximately $2,481 per month or $572 per week in take-home pay.

To understand how state income taxes may affect your earnings, consult the Tax Foundation’s overview of state income tax rates and brackets.

How to Manage $19 an Hour for Financial Stability

Earning $19 an hour can support a comfortable lifestyle if you budget wisely. Here are some actionable tips:

1. Create a Monthly Budget

- List all fixed expenses (e.g., rent, utilities).

- Set aside money for savings and discretionary spending.

2. Save for Taxes

If you’re a freelancer or work gig jobs, you may need to handle your tax deductions. Save at least 20-25% of your income for tax payments.

3. Maximize Tax Deductions

Look into deductions like student loan interest, retirement contributions, or health savings accounts (HSA) to reduce your taxable income.

4. Build an Emergency Fund

Aim to save 3-6 months’ worth of expenses to cover unexpected costs like medical bills or job loss.

Final Words: Understanding $19 an Hour

Earning $19 an hour equates to $39,520 annually before taxes and approximately $29,780 after taxes. By understanding your net income and planning your finances wisely, you can achieve greater financial control and stability.