Introduction to the Brazilian Stock Market

The Brazilian stock market is a cornerstone of South America’s largest economy, playing a critical role in driving growth and facilitating investment. Anchored by B3 (Brasil Bolsa Balcão), the primary stock exchange, Brazil’s financial markets reflect the vibrancy and diversity of its economy, spanning sectors such as energy, agriculture, banking, and technology.

For local and global investors, the Brazil stock market offers unique opportunities to gain exposure to one of the world’s most dynamic emerging markets. As a hub for trading stocks, bonds, and derivatives, the Brazil stock exchange serves as a vital platform for both domestic companies and multinational corporations seeking to tap into the country’s robust economic potential.

Understanding the Brazilian stock market is essential for investors aiming to diversify their portfolios and capitalize on the growth prospects of this emerging market. From the Ibovespa, Brazil’s benchmark stock index that tracks the performance of leading companies, to internationally traded assets like Brazil stocks on NYSE, the market offers a range of options catering to different investment strategies.

With its strategic importance and opportunities for growth, the Brazilian stock market stands out as a compelling destination for investors seeking to navigate the global financial landscape.

Understanding the Brazilian Stock Market

The Brazilian stock market operates as a dynamic financial ecosystem, connecting companies seeking capital with investors looking for growth opportunities. At its heart is B3 (Brasil Bolsa Balcão), the largest stock exchange in Latin America and the central hub for trading equities, bonds, and derivatives in Brazil. Located in São Paulo, B3 is renowned for its technological advancements and robust infrastructure, making it a vital component of Brazil’s economic framework.

Key Components of the Brazilian Stock Market

- B3 (Brasil Bolsa Balcão):

- Established as a merger of BM&FBOVESPA and CETIP, B3 is the sole stock exchange in Brazil.

- It provides a platform for listing and trading shares, ensuring market efficiency and transparency.

- B3 also facilitates derivatives, fixed-income securities, and over-the-counter (OTC) trading.

- The Ibovespa Index:

- The Ibovespa is Brazil’s benchmark stock index, tracking the performance of the most liquid and representative companies listed on B3.

- As a weighted index, it reflects the market’s overall health and serves as a barometer for investor sentiment.

- Key sectors represented in the Ibovespa include finance, energy, and materials, with major players like Petrobras, Vale, and Itaú Unibanco frequently leading the index.

- Market Operations:

- The Brazilian stock market functions on a T+2 settlement cycle, meaning trades are settled two business days after execution.

- Trading hours align with São Paulo’s local time, accommodating both domestic and international investors.

How These Elements Guide Investors

The structure of the Brazil stock market offers valuable insights for investors:

- Liquidity and Stability: B3 ensures a highly liquid market, which is crucial for entering and exiting positions efficiently.

- Performance Indicators: The Ibovespa serves as a critical tool for evaluating the overall performance of the market and identifying trends within specific sectors.

- Global Accessibility: Through mechanisms like American Depositary Receipts (ADRs), international investors can access Brazil stocks on NYSE, further integrating Brazil into the global financial system.

By understanding these foundational elements, investors can make informed decisions and strategically navigate the opportunities within the Brazilian stock market.

Key Features of Brazil’s Stock Market

The Brazilian stock market is a microcosm of the country’s vibrant and diverse economy, offering investors exposure to a range of industries that drive Brazil’s economic engine. Each sector presents unique opportunities and challenges, reflecting the complexities of an emerging market with immense potential.

Dominant Sectors of the Brazilian Economy Represented in the Stock Market

- Energy and Oil:

- Key Players: Petrobras, a state-controlled oil giant, is one of the largest companies listed on B3 and a prominent component of the Ibovespa index.

- Opportunities: Brazil’s vast oil reserves and investment in renewable energy, particularly biofuels, position the country as a global energy leader.

- Risks: Fluctuations in global oil prices and political involvement in state-owned enterprises can introduce volatility.

- Mining and Materials:

- Key Players: Vale, a world leader in iron ore and nickel production, dominates the mining sector.

- Opportunities: The global demand for raw materials, especially from China, creates significant growth prospects for mining companies.

- Risks: Dependence on commodity prices and environmental regulations pose challenges.

- Banking and Financial Services:

- Key Players: Itaú Unibanco, Banco Bradesco, and Banco do Brasil are major financial institutions listed on B3.

- Opportunities: A growing middle class and advancements in fintech offer robust growth potential in the banking sector.

- Risks: Economic downturns and high interest rates can impact credit growth and profitability.

- Agriculture and Agribusiness:

- Key Players: Companies involved in exporting soybeans, coffee, and meat play a critical role in Brazil’s stock market.

- Opportunities: Brazil’s position as a top global exporter of agricultural products ensures steady demand from international markets.

- Risks: Weather dependency and trade disputes may affect production and exports.

- Consumer Goods and Retail:

- Key Players: Companies like Ambev (beverages) and Magazine Luiza (e-commerce) represent the growing consumer market.

- Opportunities: An expanding domestic market driven by urbanization and rising disposable incomes supports growth in this sector.

- Risks: Inflation and shifts in consumer behavior can impact demand.

Growth Opportunities in Brazil’s Economy

- Emerging Market Appeal: Brazil’s large consumer base and natural resources attract foreign direct investment (FDI).

- Infrastructure Development: Government initiatives to improve transportation and energy infrastructure create investment opportunities.

- Technological Advancements: Growth in fintech, e-commerce, and digital services opens new avenues for investors.

Challenges Impacting the Stock Market

- Political Instability: Frequent policy changes and government interventions can influence market performance.

- Currency Volatility: The Brazilian real’s fluctuations affect foreign investments and company earnings.

- Inflation and Interest Rates: High inflation and central bank policies can challenge economic stability.

By analyzing these sectors and their associated risks and opportunities, investors can better navigate the Brazilian stock market and align their strategies with Brazil’s evolving economic landscape.

Investing in Brazil’s Stock Market

The Brazilian stock market offers a wealth of opportunities for both domestic and international investors. Whether you’re trading directly on the B3 (Brasil Bolsa Balcão) or accessing Brazilian companies via international platforms like the NYSE, understanding the process is crucial for success.

1. Investing Directly in the Brazilian Stock Exchange (B3)

Step 1: Open a Brokerage Account in Brazil

- To invest directly in B3, you need to open an account with a Brazilian brokerage firm.

- Most firms require a CPF (Brazilian tax identification number) for non-residents, which can be obtained through consulates or financial service providers.

Step 2: Fund Your Account

- Transfer funds to your brokerage account in Brazilian reais (BRL). Exchange rates and fees should be considered during this process.

Step 3: Research and Select Stocks

- Use market data, financial reports, and the Ibovespa index to identify potential investments.

- Popular stocks on B3 include Petrobras, Vale, Itaú Unibanco, and Ambev.

Step 4: Place Your Orders

- Through your brokerage’s trading platform, execute buy and sell orders for stocks, ETFs, or derivatives listed on B3.

Advantages of Direct Investment:

- Access to the full range of Brazilian equities and financial instruments.

- Potential for high returns due to Brazil’s growth potential.

Challenges:

- Currency risks and taxation policies may complicate investments for non-residents.

2. Investing in Brazilian Stocks via International Platforms

Option 1: American Depositary Receipts (ADRs)

- Many prominent Brazilian companies, like Petrobras (PBR) and Vale (VALE), are listed on the NYSE as ADRs.

- ADRs allow international investors to buy shares of Brazilian companies in U.S. dollars, avoiding the need to trade directly in Brazilian reais.

Option 2: Exchange-Traded Funds (ETFs)

- ETFs such as iShares MSCI Brazil ETF (EWZ) offer exposure to a diversified portfolio of Brazilian stocks.

- ETFs are an excellent choice for investors looking to mitigate risks while gaining broad exposure to the Brazilian stock market.

Advantages of International Platforms:

- Simplified transactions in local currencies like USD.

- Lower barriers to entry compared to direct investment on B3.

- Access to diversification through ETFs.

3. Tips for Successful Investment in Brazil’s Stock Market

- Understand the Risks:

- Political and economic volatility can impact market performance.

- Exchange rate fluctuations may affect international returns.

- Diversify Your Portfolio:

- Combine direct investments in Brazilian stocks with ETFs or ADRs to spread risks.

- Stay Informed:

- Monitor the Ibovespa index and global economic trends influencing Brazil’s market.

- Consult Professionals:

- Work with financial advisors or brokers experienced in emerging markets for tailored guidance.

Investing in the Brazilian stock market offers unique opportunities to tap into one of the world’s most dynamic economies. Whether you choose to invest directly through B3 or opt for ADRs and ETFs on international platforms like the NYSE, understanding the market structure and leveraging expert advice can help you navigate the complexities and maximize returns.

Brazil Stocks on NYSE: Opportunities for Global Investors

The New York Stock Exchange (NYSE) hosts several major Brazilian companies, offering global investors a convenient way to gain exposure to Brazil’s dynamic economy without directly trading on the Brazilian stock exchange, B3. These companies, often represented as American Depositary Receipts (ADRs), bridge the gap between Brazil’s emerging market potential and international accessibility.

Key Brazilian Companies Listed on the NYSE

- Petrobras (Ticker: PBR)

- Industry: Energy and Oil

- Significance: Petrobras is a state-controlled oil and gas company and one of the largest producers in the world. It is critical to Brazil’s economy, playing a leading role in energy production and exports.

- Investor Appeal:

- Global demand for energy resources.

- Strong government backing and infrastructure.

- Attractive dividends when commodity prices are high.

- Vale (Ticker: VALE)

- Industry: Mining and Materials

- Significance: Vale is one of the world’s largest producers of iron ore and nickel, crucial for industries like steelmaking and electric vehicle batteries.

- Investor Appeal:

- Strong ties to global industrial growth, particularly in China.

- Leadership in sustainable mining practices, appealing to ESG-focused investors.

- Resilience during commodity booms.

- Itaú Unibanco (Ticker: ITUB)

- Industry: Banking and Financial Services

- Significance: Itaú Unibanco is Brazil’s largest bank by market value and one of the most innovative financial institutions in Latin America.

- Investor Appeal:

- Exposure to Brazil’s growing middle class and financial sector innovation.

- Stability as a well-capitalized institution with strong earnings.

- Long-term growth potential driven by fintech expansion in Brazil.

Why These Stocks Appeal to International Investors

- Diversification into Emerging Markets:

- Investing in Brazilian companies on the NYSE allows investors to diversify their portfolios with assets from one of the most prominent emerging markets.

- Convenience and Accessibility:

- ADRs enable investments in Brazilian companies without the need to navigate foreign exchanges or currency conversions.

- Exposure to High-Growth Sectors:

- Brazil’s leading industries, such as energy, mining, and financial services, provide growth opportunities aligned with global economic trends.

- Liquidity and Stability:

- ADRs traded on the NYSE benefit from the exchange’s high liquidity and regulatory oversight, offering investors greater security.

- Dividend Opportunities:

- Many Brazilian companies, particularly in sectors like energy and mining, are known for their attractive dividend payouts, making them appealing to income-focused investors.

Brazilian companies listed on the NYSE, such as Petrobras, Vale, and Itaú Unibanco, represent a gateway to Brazil’s economic potential. For international investors, these stocks offer a unique combination of growth prospects, diversification benefits, and accessibility. By leveraging ADRs, investors can participate in the opportunities of Brazil’s thriving economy while enjoying the convenience and transparency of trading on the NYSE.

Brazil Stock Market Trends and Analysis

The Brazilian stock market, anchored by B3 (Brasil Bolsa Balcão) and its benchmark index, the Ibovespa, has experienced significant fluctuations in recent years. These trends reflect both domestic economic conditions and global market influences. By analyzing historical data and current performance, investors can gain insights into opportunities and risks in this emerging market.

Recent Performance of the Brazilian Stock Market

- Ibovespa Index Overview:

- The Ibovespa tracks the performance of the most traded stocks on B3 and serves as a key barometer of market health.

- In recent months, the index has shown resilience amid global economic uncertainty, bolstered by strong performances in the energy and financial sectors.

- Sector Highlights:

- Energy: Rising global oil prices have supported companies like Petrobras, making the energy sector a key driver of market performance.

- Financials: Major banks, including Itaú Unibanco and Banco Bradesco, have benefited from high-interest rate environments and robust earnings.

- Macroeconomic Factors:

- A strong export sector, driven by commodities such as iron ore and soybeans, has supported the economy despite inflationary pressures.

- Recent government policies aimed at fiscal consolidation have positively influenced investor confidence.

Key Trends Influencing the Brazil Stock Market

- Commodity Dependence:

- Brazil’s reliance on commodity exports means the stock market is highly sensitive to global commodity price movements, particularly for oil, iron ore, and agricultural products.

- Inflation and Interest Rates:

- With inflation rates moderating after a peak, the Central Bank of Brazil has begun signaling potential rate cuts, which could spur equity market growth.

- Foreign Investment Inflows:

- Improved political stability and economic reforms have attracted foreign capital, contributing to increased market liquidity.

- ESG and Renewable Energy Investments:

- Growing interest in sustainability has boosted companies involved in renewable energy and ESG-focused initiatives, aligning Brazil with global investment trends.

Projections for the Brazilian Stock Market

- Short-Term Outlook: Market performance is expected to remain closely tied to global economic conditions, particularly demand from China and shifts in U.S. monetary policy.

- Long-Term Growth: Structural reforms, combined with Brazil’s strategic position as a commodity powerhouse, could support sustained growth over the next decade.

Visualizing Trends: Brazil Stock Market Charts

- Historical Performance Chart:

- A line chart showcasing the Ibovespa’s performance over the past 5 years, highlighting key events such as global commodity price shifts and policy changes.

- Sector Contribution Chart:

- A bar chart showing the contributions of major sectors like energy, finance, and agriculture to the overall Ibovespa performance.

- Foreign Investment Flow Chart:

- A flow chart illustrating trends in foreign direct investment and portfolio inflows into Brazil’s equity market.

The Brazilian stock market remains a compelling destination for investors seeking exposure to emerging markets. With a combination of strong sectoral performance, improving macroeconomic conditions, and increased global interest, the market is poised for potential growth. By leveraging insights from historical data and monitoring current trends, investors can better navigate the opportunities and challenges ahead.

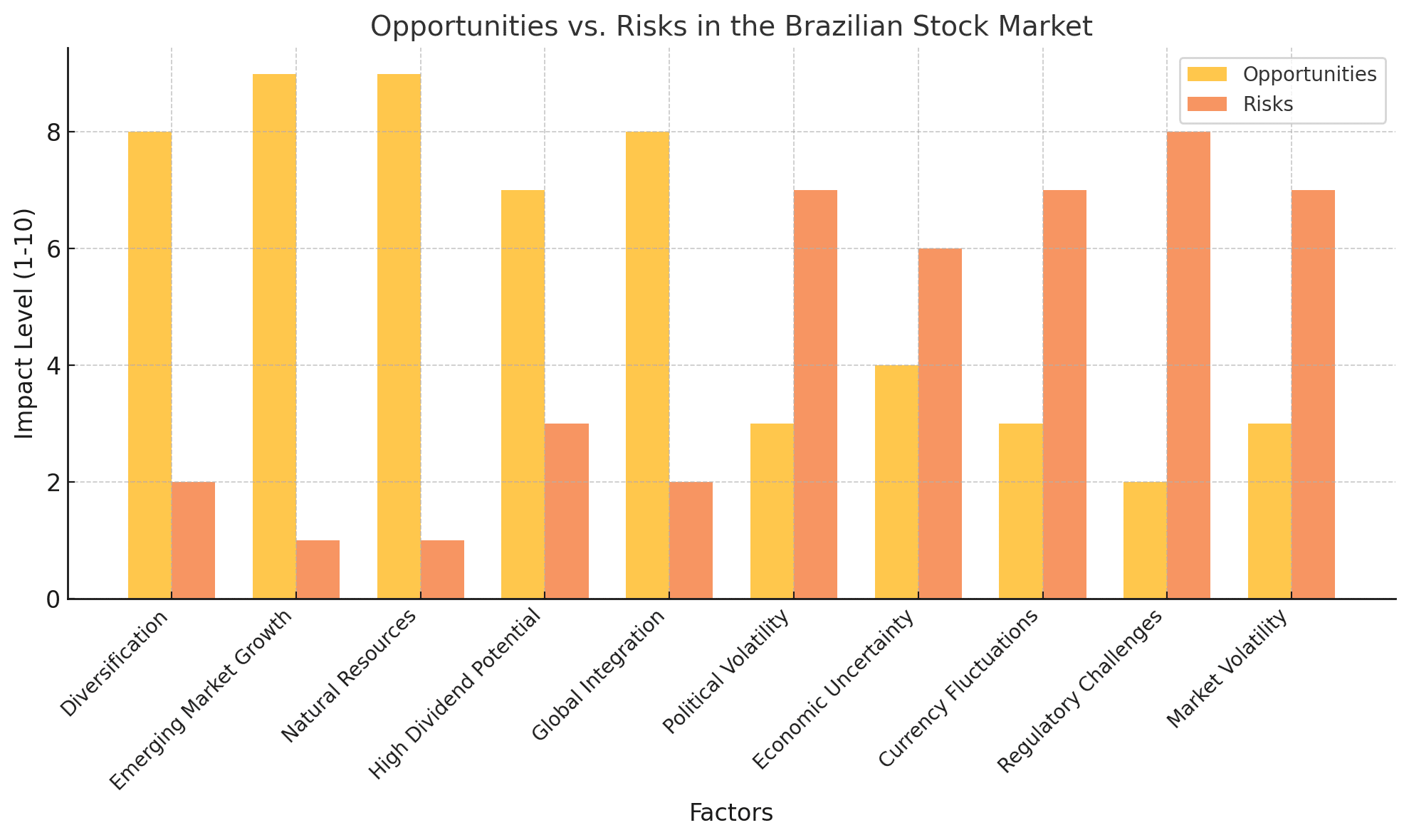

Benefits and Risks of Investing in Brazil

Investing in the Brazilian stock market offers a unique opportunity to tap into one of the world’s most vibrant emerging markets. However, like any investment, it comes with its own set of advantages and risks. By understanding these factors, investors can make informed decisions about incorporating Brazilian equities into their portfolios.

Benefits of Investing in the Brazilian Stock Market

- Portfolio Diversification:

- Exposure to Brazil provides investors with diversification beyond developed markets like the U.S. or Europe.

- Sectors such as energy, agriculture, and mining allow for investments tied to global commodity trends.

- Access to Emerging Market Growth:

- Brazil is South America’s largest economy, with a robust domestic market and a strong export base.

- Rapid urbanization and a growing middle class drive demand in sectors like consumer goods, financial services, and infrastructure.

- Rich Natural Resources:

- Brazil is a leading exporter of commodities, including iron ore, soybeans, coffee, and oil.

- Investors gain exposure to industries critical to global trade and industrial production.

- High Dividend Potential:

- Many Brazilian companies, particularly in energy and mining, are known for paying attractive dividends, making them appealing for income-focused investors.

- Global Integration:

- Companies like Petrobras, Vale, and Itaú Unibanco are listed on international exchanges such as the NYSE, making it easier for global investors to participate without currency conversion or direct exposure to Brazil’s stock exchange.

Risks of Investing in the Brazilian Stock Market

- Political Volatility:

- Frequent changes in government policies and political instability can impact market confidence and investor sentiment.

- State-owned enterprises, such as Petrobras, are particularly sensitive to government decisions.

- Economic Uncertainty:

- Brazil has faced challenges like high inflation, fluctuating interest rates, and slower GDP growth in recent years.

- Dependency on commodity exports makes the economy vulnerable to global price swings.

- Currency Fluctuations:

- The Brazilian real (BRL) is subject to significant volatility against major currencies like the U.S. dollar.

- Currency depreciation can reduce the value of returns for foreign investors.

- Regulatory and Taxation Challenges:

- Complex tax structures and regulatory requirements may pose difficulties, especially for non-resident investors.

- Withholding taxes on dividends and capital gains can impact overall returns.

- Market Volatility:

- The Brazilian stock market tends to experience higher volatility compared to developed markets, partly due to its emerging market status and sensitivity to external factors like U.S. monetary policy and global trade dynamics.

Weighing the Pros and Cons

Benefits:

- Diversification and access to high-growth sectors make Brazil an attractive choice for global investors.

- Opportunities in commodities, infrastructure, and consumer-driven industries align with global trends.

Risks:

- Economic and political uncertainties require a cautious and well-researched approach.

- Currency risk and regulatory hurdles should be carefully managed.

Investing in the Brazilian stock market offers significant opportunities for growth and diversification but demands a thorough understanding of the associated risks. By staying informed about political and economic developments and leveraging tools like ADRs and ETFs, investors can mitigate risks and optimize their exposure to one of the world’s most promising emerging markets.

Investing in the Brazilian Stock Market

The Brazilian stock market represents a dynamic and promising avenue for investors seeking exposure to emerging markets. With its strong foundation in key industries such as energy, mining, and agriculture, Brazil offers unique opportunities for diversification and high-growth potential. The presence of internationally traded stocks like Petrobras, Vale, and Itaú Unibanco, coupled with accessible investment tools such as ADRs and ETFs, makes Brazil a compelling choice for both novice and experienced investors.

However, investing in Brazil also comes with challenges, including political volatility, economic uncertainties, and currency fluctuations. A well-informed approach is essential to navigate these risks effectively and maximize the benefits of this vibrant market.

For those ready to explore the potential of global investing, understanding the intricacies of markets like Brazil is an important step toward building a robust and diversified portfolio.