How to Qualify for a $255 Payday Loan Online

While the requirements for $255 payday loans online may vary slightly from lender to lender, there are some general qualifications that most lenders will expect you to meet. These typically include:

- Age and Residency: You must be at least 18 years old and a legal resident of the state in which you’re applying for the loan.

- Employment and Income: Lenders will require proof of steady employment and a minimum monthly income, usually around $1,000 or more. This ensures that you have the means to repay the loan.

- Active Bank Account: You’ll need an active checking or savings account where the loan funds can be deposited and from which repayments can be withdrawn.

- Valid Identification: You’ll be required to provide a valid government-issued ID, such as a driver’s license or state ID card.

It’s important to note that while $255 payday loans online may not require a credit check, lenders will still conduct basic verifications to ensure you meet their eligibility criteria.

The Application Process for $255 Payday Loans Online

The application process for $255 payday loans online is designed to be quick and straightforward. Here’s a general overview of what you can expect:

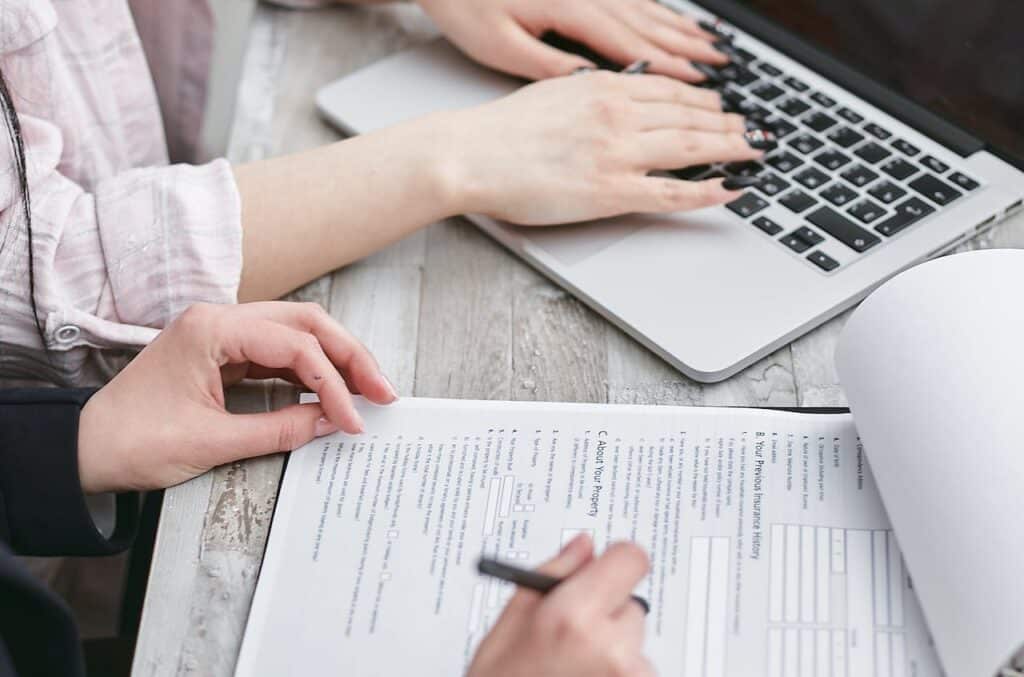

- Online Application: Most lenders offer an online application form that you can complete from any device with an internet connection. This typically involves providing personal and financial information, such as your name, address, employment details, and income.

- Document Submission: You may be required to submit supporting documents, such as pay stubs, bank statements, or a copy of your ID. Many lenders now offer the option to upload these documents electronically, further streamlining the process.

- Approval and Funding: Once your application and documents have been reviewed and approved, the lender will typically deposit the loan funds directly into your provided bank account. This can often happen on the same day or within 24 hours, depending on the lender’s policies and processing times.

- Repayment: Most $255 payday loans online have a short repayment period, typically ranging from two weeks to a month. The lender will typically deduct the loan amount, plus any applicable fees and interest, from your next paycheck or bank account on the agreed-upon due date.

It’s important to carefully review the terms and conditions of the loan before accepting it, as these can vary between lenders and may impact factors such as interest rates, fees, and repayment schedules.

Tips for Using $255 Payday Loans Responsibly

While $255 payday loans online can provide much-needed financial relief, it’s crucial to use them responsibly to avoid falling into a cycle of debt. Here are some tips to help you navigate these loans successfully:

- Borrow Only What You Need: It can be tempting to borrow more than you require, but this can lead to higher interest charges and more difficulty in repaying the loan. Stick to borrowing only the amount you need to cover your immediate expenses.

- Create a Repayment Plan: Before taking out a $255 payday loan online, ensure that you have a solid plan in place for repaying it on time. Factor in your upcoming income and expenses to ensure you can comfortably make the repayment without falling behind on other obligations.

- Avoid Rollovers or Renewals: While some lenders may offer the option to roll over or renew your loan, this can quickly lead to a cycle of debt and exorbitant fees. Aim to repay the loan in full on the agreed-upon due date.

- Explore Alternatives: If you find yourself consistently relying on $255 payday loans online, it may be time to explore alternative solutions, such as budgeting, debt consolidation, or seeking financial counseling.

- Read and Understand the Terms: Before signing any loan agreement, take the time to carefully read and understand all the terms and conditions. Pay close attention to the interest rates, fees, and repayment schedules to ensure you’re making an informed decision.

By following these tips, you can use $255 payday loans online as a responsible and effective solution for short-term financial needs without compromising your long-term financial health.

Common Misconceptions About $255 Payday Loans

Despite their popularity and convenience, $255 payday loans online are often surrounded by misconceptions and myths. Let’s address some of the most common ones:

- Myth: Payday Loans are a Debt Trap: While it’s true that some individuals may struggle to repay payday loans, this is often due to a lack of financial planning or responsible borrowing practices. When used as intended – for short-term financial needs – and repaid on time, $255 payday loans online can be a valuable financial tool.

- Myth: Payday Lenders are Predatory: Reputable lenders offering $255 payday loans online are subject to strict regulations and transparency requirements. They must clearly disclose all fees, interest rates, and terms to ensure borrowers are fully informed before agreeing to the loan.

- Myth: Payday Loans Have Exorbitant Interest Rates: While payday loan interest rates may be higher than traditional loans, this is because they are designed for short-term use. When calculated as an annual percentage rate (APR), the interest rates may seem high, but for a two-week or one-month loan, the actual interest paid can be relatively low.

- Myth: Payday Loans are Only for Those with Bad Credit: While $255 payday loans online may be an option for those with poor or no credit history, they are also utilized by individuals with good credit who simply need a short-term financial solution.

- Myth: Payday Loans are Unregulated: Most states have specific regulations and laws governing payday lending practices, including caps on fees and interest rates, as well as requirements for lender transparency and consumer protection.

By understanding and debunking these common misconceptions, you can make more informed decisions about whether a $255 payday loan online is the right solution for your financial needs.

Alternatives to $255 Payday Loans Online

While $255 payday loans online can be a convenient solution for short-term financial needs, they may not be the best option for everyone. Here are some alternatives to consider:

- Personal Loans: If you have good credit and a stable income, you may qualify for a personal loan from a bank or credit union. These loans typically have lower interest rates and more flexible repayment terms than payday loans.

- Credit Card Advances: If you have a credit card with available credit, you may be able to take a cash advance. While interest rates on cash advances can be high, they may still be lower than those of payday loans.

- Borrowing from Friends or Family: While it can be uncomfortable, borrowing from trusted friends or family members can be a more affordable option than payday loans, especially if they don’t charge interest.

- Negotiating with Creditors: If you’re facing financial difficulties, reach out to your creditors and explain your situation. They may be willing to work with you on a payment plan or temporarily reduce your interest rates or fees.

- Seeking Assistance Programs: Depending on your circumstances, you may qualify for government assistance programs, non-profit organizations, or community resources that can provide financial aid or counseling.

- Selling Assets: If you have valuable items you no longer need, consider selling them to generate cash for your immediate financial needs.

- Cutting Expenses: Take a close look at your budget and identify areas where you can temporarily reduce or eliminate non-essential expenses to free up funds.

While these alternatives may not provide the same level of speed and convenience as $255 payday loans online, they can potentially offer more favorable terms and help you avoid the potential pitfalls of high-interest, short-term loans.

Finding Reputable Lenders for $255 Payday Loans Online

If you’ve explored all other options and determined that a $255 payday loan online is the best solution for your immediate financial needs, it’s crucial to work with a reputable and trustworthy lender. Here are some tips for finding a reliable lender:

- Check for Proper Licensing and Regulation: Ensure that the lender is properly licensed and regulated in your state. Many states have specific requirements for payday lenders, and reputable companies will proudly display their licensing information.

- Read Customer Reviews: Take the time to read customer reviews and ratings for potential lenders. Look for patterns in both positive and negative feedback to gauge the lender’s reputation and customer service.

- Verify Transparency: A reputable lender should be upfront and transparent about all fees, interest rates, and terms associated with their $255 payday loans online. If you encounter any hesitancy or obfuscation, consider it a red flag.

- Check for Secure Transactions: Ensure that the lender’s website is secure and encrypted, especially when transmitting sensitive personal and financial information.

- Avoid Lenders with Excessive Fees or Interest Rates: While payday loan interest rates are generally higher than traditional loans, excessive fees or interest rates that seem unreasonable should be a cause for concern.

- Consult Industry Watchdog Groups: Organizations like the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB) can provide valuable information and resources on reputable payday lenders.

By taking the time to thoroughly research and vet potential lenders, you can increase your chances of working with a reputable company that prioritizes transparency, fair practices, and customer satisfaction.

The Importance of Reading the Terms and Conditions for $255 Payday Loans

Before signing any loan agreement, it’s crucial to carefully read and understand the terms and conditions associated with the $255 payday loan online. These documents outline the specific details of the loan, including:

- Interest Rates: The annual percentage rate (APR) and any additional fees or charges that will be applied to the loan.

- Repayment Schedule: The due date(s) for repaying the loan, as well as any penalties or fees for late or missed payments.

- Rollover or Renewal Policies: Whether the lender allows for rollovers or renewals, and any associated fees or charges.

- Collection Practices: The procedures the lender may follow in the event of non-payment, including potential legal actions or reporting to credit bureaus.

- Privacy and Data Protection: How the lender handles and protects your personal and financial information.

- Customer Service and Dispute Resolution: The channels and procedures for addressing any issues or disputes that may arise during the loan process.

By thoroughly reviewing and understanding these terms and conditions, you can make an informed decision about whether the $255 payday loan online is truly the best option for your specific financial situation. It also helps you avoid any unexpected surprises or hidden fees down the line.

If you have any questions or concerns about the terms and conditions, don’t hesitate to reach out to the lender for clarification before proceeding with the loan. A reputable lender should be willing to address your questions and ensure you have a clear understanding of the agreement. If you’re facing a financial emergency and need immediate relief, consider applying for a $255 payday loan online with same-day deposit. Visit our trusted lending partners to explore your options and find a solution that fits your unique needs. Don’t let unexpected expenses derail your financial stability – take control today with the convenience and flexibility of $255 payday loans online.