Life can throw financial challenges at you when you least expect them. Whether it’s an unexpected medical bill, car repair, or a temporary cash flow issue, having access to quick loans can be a lifesaver. With options like fast loans, online loans, and same day loans, quick loans offer a range of solutions for urgent financial needs.

This comprehensive guide will explore everything you need to know about quick loans. From understanding what they are to weighing their pros and cons, we’ll provide actionable advice to help you make the best decision for your financial situation.

What Are Quick Loans?

A quick loan is a type of short-term loan designed to provide borrowers with immediate access to funds. Unlike traditional loans, which often require lengthy applications and weeks of processing, quick loans prioritize speed and convenience. These loans can be used for a variety of purposes, from paying emergency medical bills to fixing a broken appliance.

Key Features of Quick Loans

- Fast Approval: Many quick loan lenders provide approval decisions within minutes.

- Immediate Funding: Borrowers often receive funds on the same day or the next business day.

- Online Applications: Most quick loans are available through digital platforms, eliminating the need for paperwork or in-person visits.

- Flexible Eligibility: Lenders often cater to individuals with bad credit, focusing more on income and ability to repay.

Common Uses for Quick Loans

Quick loans are incredibly versatile and can be used for:

- Covering financial emergencies such as medical bills, urgent home repairs, or unexpected travel expenses.

- Bridging short-term cash flow gaps, such as managing bills between paychecks.

- Paying for unforeseen expenses like car repairs or replacing a broken refrigerator.

These loans are designed to address immediate needs, making them unsuitable for long-term financial planning or large purchases.

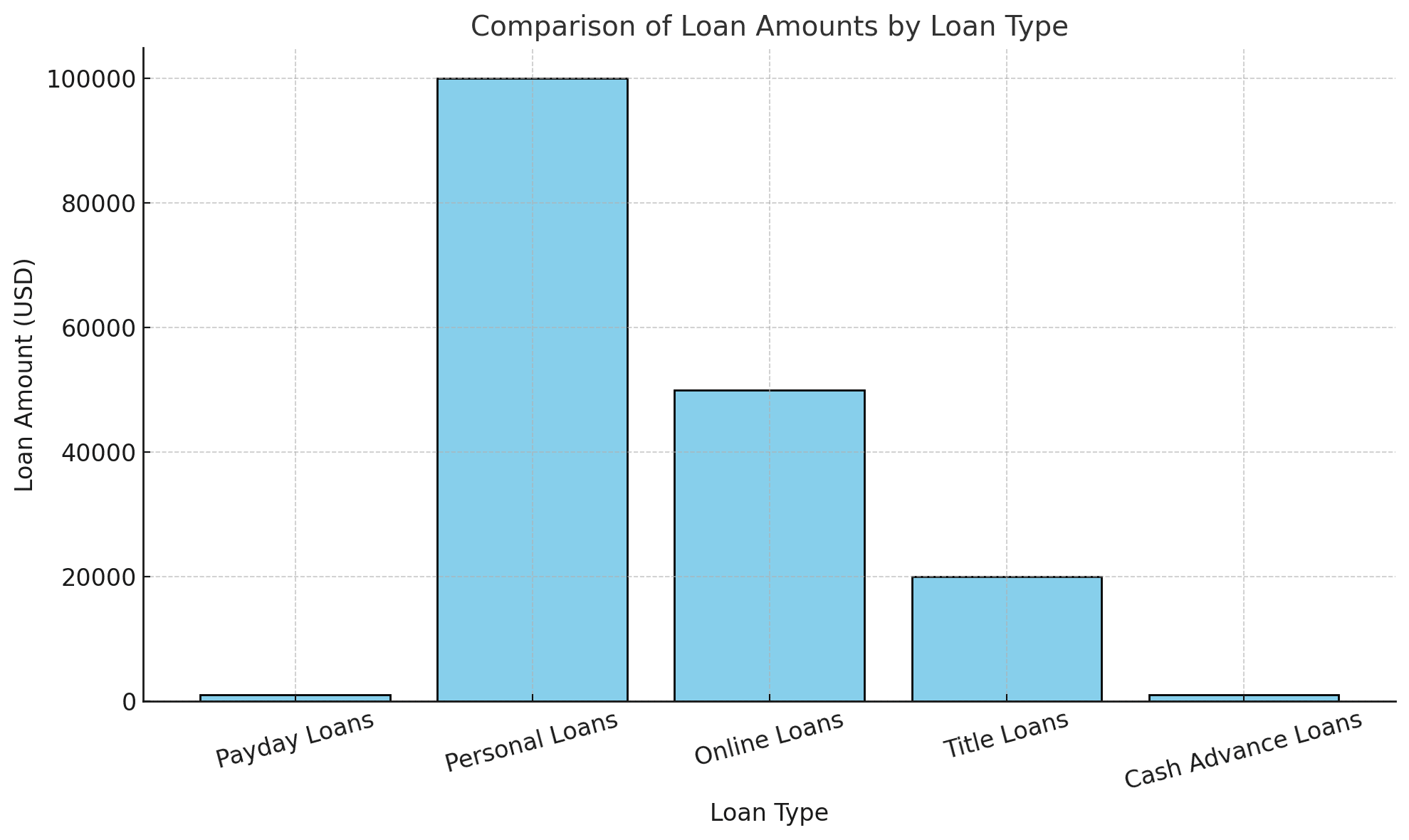

Types of Quick Loans

There are several types of quick loans, each catering to specific needs. Here’s a detailed look at the most common options.

Payday Loans

Payday loans are short-term loans that must be repaid in full by your next paycheck. They typically range from $100 to $1,000 and are known for their easy approval process. These loans are ideal for small, immediate expenses like utility bills.

Advantages:

- No credit check required, making them accessible to borrowers with poor credit.

- Funds are typically available within hours.

Disadvantages:

- Extremely high interest rates, often exceeding 400% APR.

- Full repayment is required in a single lump sum, which can be challenging.

Example: Imagine your car breaks down, and you need $500 for repairs. A payday loan might help you cover the expense until your next paycheck. However, if you don’t repay it on time, you could face steep fees and interest.

Personal Loans

Personal loans are installment loans that can range from $1,000 to $100,000. They offer longer repayment terms, typically spanning months or even years, and lower interest rates compared to payday loans.

Advantages:

- Competitive interest rates, especially for borrowers with good credit.

- Fixed monthly payments make budgeting easier.

Disadvantages:

- Requires a credit check, which may disqualify some borrowers.

- Funding times may be slower than same-day loans, though some online lenders expedite the process.

Example: If you need $10,000 to cover medical expenses, a personal loan provides structured repayment over several years, making it manageable within your budget.

Online Loans

Online loans are designed for convenience, allowing borrowers to complete the entire application process digitally. They are offered by fintech companies and cater to various financial needs, from cash advance loans to bad credit loans.

Advantages:

- Instant approval decisions in many cases.

- Paperless process with funds deposited directly into your account.

Disadvantages:

- Interest rates may vary significantly based on your creditworthiness.

- Some lenders may charge additional fees, such as processing or origination fees.

Example: You’re moving apartments and need $2,000 for security deposits and moving costs. An online loan allows you to apply, get approved, and receive the funds within 24 hours—all from your phone.

Title Loans

Title loans are secured loans where borrowers use their car as collateral. Loan amounts depend on the vehicle’s value, and repayment terms are often short.

Advantages:

- No credit check required, as the loan is secured by collateral.

- Borrowers can access larger amounts compared to payday loans.

Disadvantages:

- High risk of losing your vehicle if you default.

- Interest rates and fees are often high.

Example: If you need $5,000 quickly and own a car outright, a title loan may provide the funds you need. However, failing to repay could result in repossession of your car.

Cash Advance Loans

Cash advance loans allow you to borrow against your next paycheck or available credit card limit. These loans are quick but often expensive due to high fees.

Advantages:

- Immediate access to cash.

- No separate loan application is required for credit card cash advances.

Disadvantages:

- High interest rates and fees can make these loans costly.

- Potential to fall into a debt cycle if not repaid promptly.

Example: You’re short on cash for groceries and need $300. A cash advance loan can bridge the gap until your next paycheck, but repayment must be immediate to avoid additional fees.

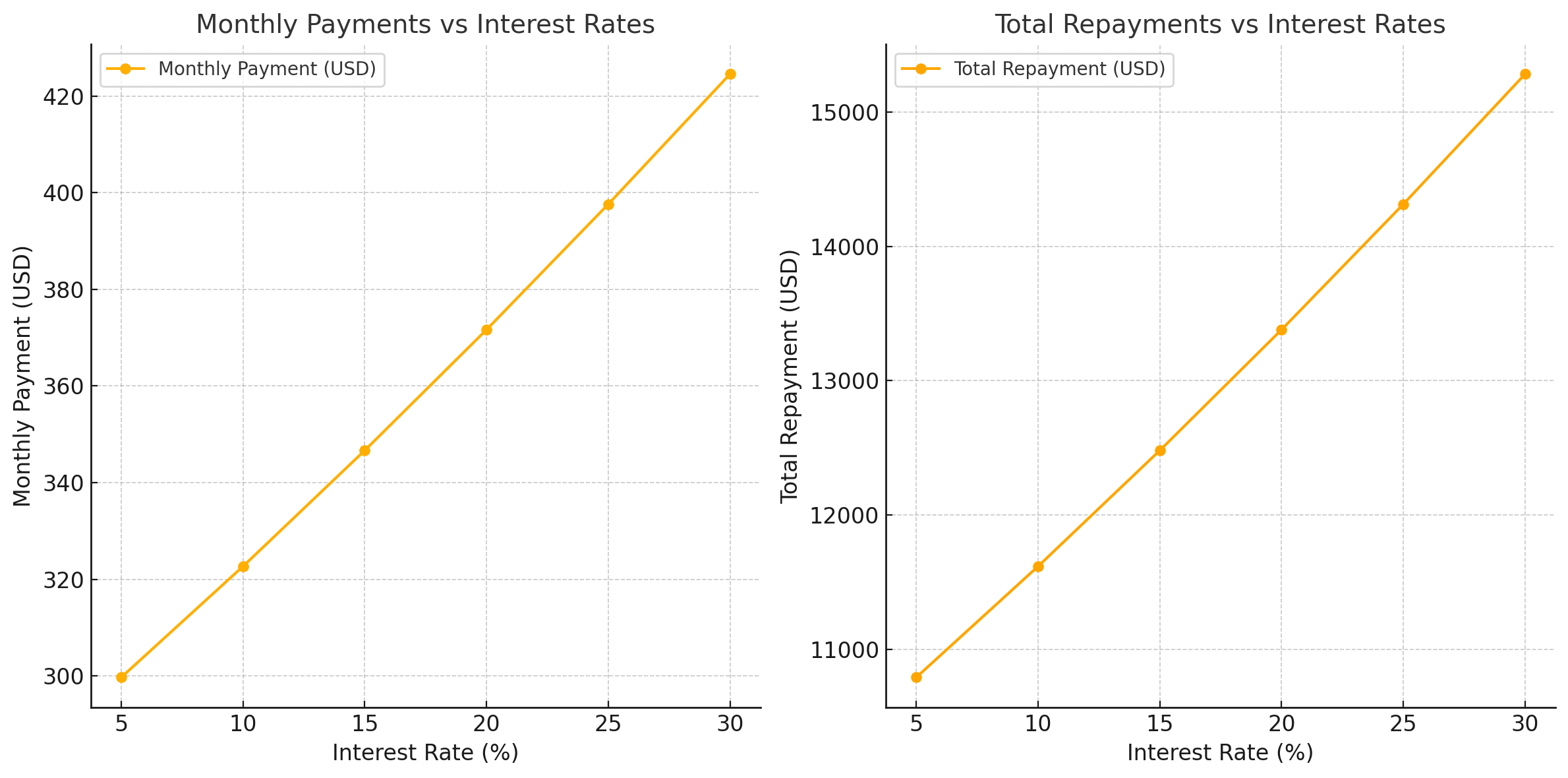

How do interest rates impact repayments?

Interest rates significantly impact the total cost of borrowing and the size of your repayments.

Here are two visualizations that demonstrate how interest rates impact loan repayments:

- Monthly Payments vs. Interest Rates: This chart shows how increasing interest rates lead to higher monthly payments.

- Total Repayments vs. Interest Rates: This chart illustrates the overall cost of the loan increasing significantly with higher interest rates.

Here’s how they influence your loan:

1. Higher Interest Rates Increase Total Repayment Amount

The interest rate determines how much you pay in addition to the principal (borrowed amount). The higher the rate, the more expensive the loan becomes over time. For example:

- A loan with a 10% interest rate will cost less than a loan with a 25% interest rate, even if the principal and repayment period are the same.

Example:

- Loan Amount: $10,000

- Loan Term: 3 years

- Interest Rate: 10%

- Total repayment = $11,616 ($10,000 principal + $1,616 interest)

- Interest Rate: 25%

- Total repayment = $14,131 ($10,000 principal + $4,131 interest)

2. Monthly Payments Are Affected

Higher interest rates increase the size of your monthly payments. If you’re on a tight budget, even small percentage increases in the rate can strain your finances.

Example:

- Loan Amount: $10,000

- Loan Term: 3 years

- Interest Rate: 10%

- Monthly payment = $322

- Interest Rate: 25%

- Monthly payment = $392

3. Short-Term Loans vs. Long-Term Loans

The impact of interest rates depends on the loan term:

- Short-Term Loans: Higher monthly payments but lower total interest paid because the repayment period is shorter.

- Long-Term Loans: Lower monthly payments but more total interest paid because the repayment period is longer.

Example:

- Loan Amount: $10,000

- Interest Rate: 10%

- 3-Year Loan: $11,616 total repayment

- 5-Year Loan: $12,748 total repayment

4. Compounding Interest

Some loans calculate interest monthly or daily, leading to “compounding.” This means you pay interest not just on the principal but also on any accrued interest. Payday loans and cash advances often use daily compounding, making them much more expensive.

Example of Compounding:

- Loan Amount: $1,000

- Daily Interest Rate: 1% (365% APR)

- After 1 month, repayment = $1,305 ($1,000 principal + $305 interest)

5. Variable vs. Fixed Interest Rates

- Fixed Rates: The interest rate remains constant throughout the loan term, ensuring consistent repayments.

- Variable Rates: The interest rate may fluctuate based on market conditions, causing monthly payments to vary.

Impact:

A variable rate can start low but increase over time, making repayments unpredictable and potentially more expensive.

6. Loan Type Matters

Different types of loans have different interest rates:

- Payday Loans: Extremely high rates (300%-400%+ APR), leading to high total costs even for small loans.

- Personal Loans: Moderate rates (5%-35% APR), offering a better balance between affordability and accessibility.

- Title Loans: High rates (100%-300% APR) but higher loan amounts.

Key Takeaway

Interest rates are a critical factor when choosing a loan. A higher interest rate increases your monthly payments and the total amount you’ll repay. Always compare lenders, calculate total repayment costs, and prioritize loans with lower interest rates whenever possible. Let me know if you’d like a detailed repayment calculation or chart for a specific scenario!

How to Apply for a Quick Loan

Applying for a quick loan is a straightforward process. Follow these steps to ensure success:

- Assess Your Needs: Determine how much money you require and whether you can repay it within the loan’s terms.

- Research Lenders: Compare interest rates, fees, and terms from multiple lenders offering online loans, same-day loans, or fast loans.

- Gather Required Documents: Common requirements include a government-issued ID, proof of income (e.g., pay stubs), and proof of residency (e.g., utility bills).

- Submit Your Application: Complete the application accurately and honestly to avoid delays.

- Review Loan Terms: Carefully read the agreement, including the APR, repayment schedule, and fees.

- Receive Funds: Once approved, funds are typically deposited into your account within hours or by the next business day.

Pros and Cons of Quick Loans

Pros:

- Fast Funding: Ideal for emergencies where immediate cash is needed.

- Convenient Application: Most applications can be completed online in minutes.

- Flexible Eligibility: Options available for borrowers with poor credit or no credit history.

- Diverse Options: From payday loans to personal loans, there’s a loan for almost every situation.

Cons:

- High Interest Rates: Payday loans and cash advances often carry steep fees.

- Short Repayment Terms: Tight deadlines can strain your finances.

- Risk of Debt Cycles: Missing payments may result in rollover loans and escalating fees.

- Collateral Risks: For secured loans like title loans, failure to repay may result in asset loss.

Federal Trade Commission (FTC) – Payday Loans and Cash Advances

Link: https://www.consumer.ftc.gov/articles/0149-payday-loans-and-cash-advances

Alternatives to Quick Loans

If a quick loan isn’t the right fit, consider these alternatives:

- Personal Savings: Tapping into your emergency fund is often the cheapest option.

- Credit Card Cash Advances: While these have fees, they may cost less than payday loans.

- Borrowing from Friends or Family: Interest-free assistance can alleviate short-term financial strain.

- Local Assistance Programs: Many nonprofits and charities offer financial aid for emergencies.

Tips for Using Quick Loans Responsibly

- Borrow Only What You Need: Avoid taking on more debt than necessary.

- Understand the Costs: Use a loan calculator to estimate the total repayment amount.

- Repay on Time: Late payments can damage your credit score and result in additional fees.

- Shop Around: Compare offers from multiple lenders to find the best terms.

- Verify the Lender: Ensure the lender is licensed and has positive reviews.

Are Quick Loans Right for You?

Quick loans can provide immediate relief in emergencies, offering fast loans, online loans, and same-day loans for various needs. However, they come with risks, particularly if repayment terms are not met. By understanding your options, comparing lenders, and using alternatives when possible, you can make a decision that aligns with your financial goals. If you’re considering a quick loan, research reputable lenders, review terms carefully, and borrow responsibly to ensure a positive borrowing experience.